TLDR

- Apple iPhone 17 launch event Tuesday features new “Air” model and Pro versions

- August inflation data Thursday influences Fed’s September 17 rate cut decision

- Nvidia, Meta, Microsoft present at Goldman Sachs tech conference this week

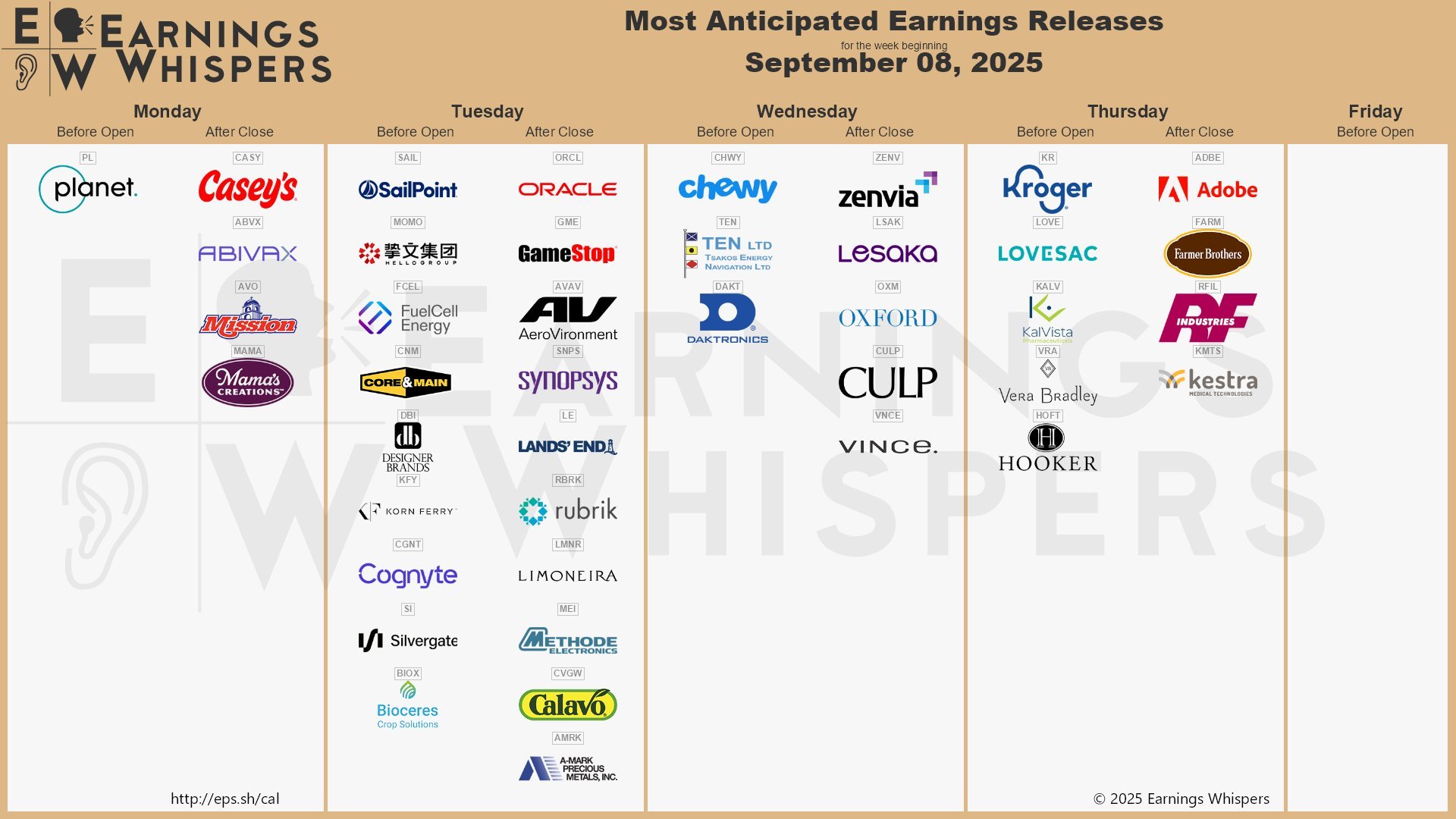

- Oracle earnings Tuesday follow strong cloud deals, GameStop reports after revenue drop

- Producer Price Index Wednesday and consumer sentiment Friday round out economic calendar

Apple’s highly anticipated iPhone 17 launch event takes center stage Tuesday as investors await crucial inflation data that could shape Federal Reserve policy decisions.

The iPhone 17 launches this month 🔥 pic.twitter.com/MrOnhjJVE6

— Apple Hub (@theapplehub) September 1, 2025

The tech giant will unveil multiple iPhone 17 models at its Tuesday event. Apple plans to introduce a thin “Air” version alongside traditional Pro models, marking the latest evolution in smartphone design.

The iPhone 17 series will showcase enhanced artificial intelligence features as Apple competes in the growing AI smartphone market. Industry analysts expect the new models to drive significant upgrade cycles among existing iPhone users.

Major Tech Companies Present at Goldman Sachs Conference

Leading technology companies will deliver presentations at the Goldman Sachs Communacopia + Technology Conference throughout the week. Nvidia kicks off Monday’s sessions, followed by Meta Platforms and Broadcom on Tuesday.

Microsoft and Workday close out conference presentations Wednesday. These events provide investors with updates on AI development, cloud computing growth, and future technology trends across the sector.

The conference timing coincides with Apple’s iPhone launch, creating a concentrated week of tech industry news and market-moving announcements.

Inflation Data Could Impact Fed Rate Decision

Thursday’s Consumer Price Index release for August represents the final major inflation reading before the Federal Reserve’s September 17 meeting. Fed officials face mounting pressure to cut interest rates following recent labor market weakness.

The CPI data will show whether price pressures continued at current levels during August. July’s inflation report showed prices rose less than expected, supporting arguments for monetary policy easing.

Oracle reports quarterly earnings Tuesday after CEO Safra Catz highlighted strong fiscal year momentum. The cloud computing provider recently closed several large enterprise deals, boosting revenue expectations.

Adobe releases earnings Thursday with investors focused on artificial intelligence demand trends. The graphic software company previously raised full-year guidance after beating earnings expectations.

GameStop publishes quarterly results Tuesday following a challenging previous period. The gaming retailer reported 17% revenue decline and announced plans for additional funding, raising questions about business sustainability.

The meme stock faces continued headwinds from digital game downloads reducing physical sales. Investors will monitor progress on transformation initiatives and cost reduction efforts.

Wednesday brings the Producer Price Index for August, providing wholesale inflation insights. Friday concludes the week with preliminary September consumer sentiment data.

These economic indicators will help shape market expectations for Federal Reserve policy changes and broader economic conditions heading into the fourth quarter.