TLDR

- September jobs report Friday will show labor market strength after Fed rate cuts due to unemployment worries

- ISM Manufacturing PMI Wednesday and Services PMI Friday measure business conditions across key economic sectors

- Government shutdown deadline Tuesday could delay critical economic data releases before next Fed meeting

- Nike earnings Tuesday spotlight turnaround progress while Tesla deliveries Thursday benefit from tax credit rush

- Fed officials including John Williams speak this week on monetary policy and labor market conditions

The September 2025 jobs report takes center stage this week as investors and Federal Reserve officials seek clarity on labor market conditions following the central bank’s recent interest rate cuts.

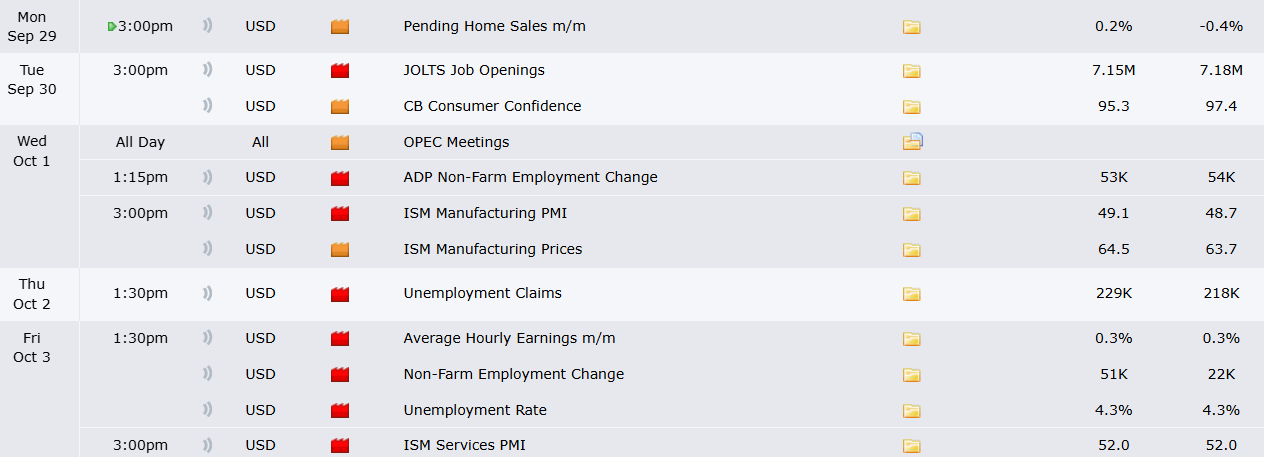

Friday’s employment data from the Bureau of Labor Statistics comes after Fed Chair Jerome Powell cited rising unemployment as a key factor behind September’s rate reduction. August job creation slowed to just 22,000 new positions, well below recent monthly averages, while the unemployment rate ticked higher.

The jobs report leads a packed week of economic indicators that could reshape Fed policy expectations and market sentiment heading into the fourth quarter.

Fed Officials Watch Labor Market Data Closely

Powell described the central bank’s current position as “challenging” given persistent inflation above the 2% target alongside rising unemployment concerns. Several Fed officials are scheduled to speak this week, including New York Fed President John Williams and Cleveland Fed President Beth Hammack, who may provide additional guidance on future rate decisions.

Core PCE inflation data released last Friday matched economist expectations, reinforcing hopes for additional Fed rate cuts while showing contained price pressures. However, Fed officials have signaled a more cautious approach to monetary easing than some investors anticipated.

The University of Michigan consumer sentiment index declined in September for the third straight month. Households expressed growing concerns about inflationary pressures and labor market weakness, creating mixed signals for policymakers.

Key Economic Reports Shape Market Outlook

Wednesday brings the September ISM Manufacturing PMI at 10:00 AM Eastern. This purchasing managers index measures business conditions across the manufacturing sector and serves as a leading economic indicator for broader economic trends.

Friday’s ISM Services PMI carries equal importance as the services sector contributes over 70% of U.S. gross domestic product. Both PMI readings help economists anticipate changing business conditions before they appear in other economic data.

Second-quarter GDP growth was revised upward to 3.8% annualized from the previously reported 3.3%. Personal income and spending data also exceeded expectations, pointing to continued economic momentum despite labor market concerns.

Government shutdown negotiations add uncertainty to the economic calendar. The Tuesday night deadline could disrupt publication of essential economic data, including jobs reports and inflation indexes, ahead of the next Federal Reserve meeting.

Corporate Earnings Provide Additional Market Catalysts

Nike reports quarterly earnings Tuesday as investors monitor turnaround efforts under CEO Elliott Hill. The athletic apparel maker posted smaller-than-expected profit and sales declines in its most recent quarterly report.

#earnings for the week of September 29, 2025https://t.co/hLn2sKQPuw$NKE $CCL $PRGS $JEF $AYI $CAG $IVA $MTN $LW $RZLV $UNFI $ANGO $NG $CALM $PAYX $RPM pic.twitter.com/AvMLa7bFXo

— Earnings Whispers (@eWhispers) September 26, 2025

Tesla delivery numbers expected Thursday could provide upside surprises as consumers rush to claim federal EV tax credits before they expire at month-end. The electric vehicle maker’s stock has gained momentum recently on anticipation of strong quarterly deliveries.

Carnival Corporation reports Monday as the cruise operator looks to extend recent operational success. ConAgra Brands releases results Wednesday after the food manufacturer reported 4% sales decline in the prior quarter.

Stock markets ended last week with small losses despite Friday’s rebound. The S&P 500 fell 0.31% while the Nasdaq-100 dropped 0.50% for the week, snapping three-week winning streaks for major indexes.