TLDR

- Federal Reserve cuts rates for first time in 2025, driving all major US indexes to record highs

- PCE inflation data Friday will influence future Fed policy decisions and market direction

- Fed Chair Powell and new board member Stephen Miran set to speak this week

- Micron earnings Tuesday expected to show continued AI chip demand strength

- Energy markets decline despite rate cuts as OPEC+ increases production output

The Federal Reserve’s decision to cut interest rates for the first time in 2025 has created a historic moment for US stock markets. All three major indexes closed at record levels Thursday, marking the first time since 2021 that the S&P 500, Nasdaq, and Dow Jones reached new peaks simultaneously.

Friday extended the celebration with another round of record closes for major indexes. The rate cut has sparked the largest weekly stock inflows since December, totaling $57.7 billion according to Bank of America data.

Fed Chair Jerome Powell warned that elevated inflation and weakening labor markets present challenges ahead. Despite cutting rates, the central bank signaled caution about future moves, making this week’s economic data crucial for policy direction.

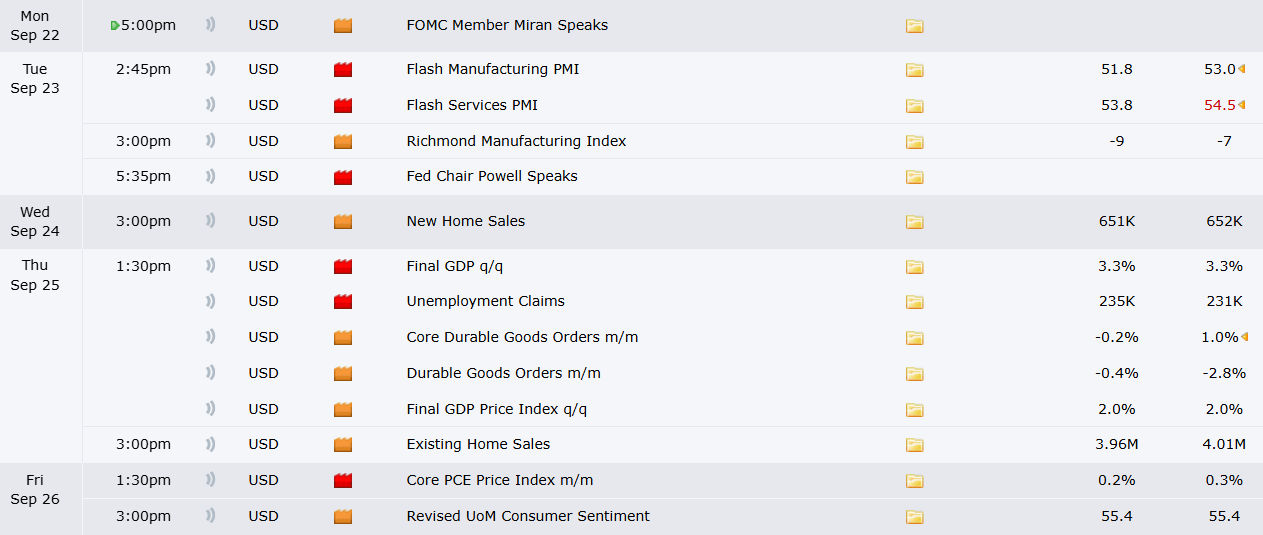

Critical Economic Data Pipeline

The Personal Consumption Expenditures index arrives Friday as the Fed’s preferred inflation measure. Core PCE inflation is expected to ease to 0.2% in August, while annual increases may hold at 2.9% – still above the Fed’s 2% target.

Multiple Fed officials will deliver remarks throughout the week, including Powell and newly appointed Governor Stephen Miran. Their comments will be parsed for hints about the remaining two Fed meetings this year.

Thursday brings the final second-quarter GDP revision, previously adjusted higher in August. New and pending home sales data will reflect recent mortgage rate declines that have reached near one-year lows.

Consumer sentiment, jobless claims, and durable goods orders round out the economic calendar. These reports will help determine whether the Fed’s dovish pivot continues or faces resistance from persistent inflation.

Corporate Earnings Spotlight

Micron Technology reports Tuesday after shares hit record highs last week. The memory chip maker delivered record quarterly revenue in June, driven by surging data center demand for AI applications.

#earnings for the week of September 22, 2025https://t.co/hLn2sKQhEY$MU $COST $ACN $AZO $KMX $KBH $CTAS $AIR $UEC $FUL $BB $WOR $FLY $SFIX $JBL $MLKN $CNXC $SNX $KNOP $LGCY $LPTH $LUXE $MRT $THO $GNFT $AYTU $SCS $WS pic.twitter.com/MVlRppgybE

— Earnings Whispers (@eWhispers) September 19, 2025

Analyst expectations remain elevated for Micron as artificial intelligence continues driving semiconductor demand. Revenue guidance will be closely watched for insights into the AI chip market’s sustainability.

Costco releases quarterly results Thursday following May’s 8% sales growth and continued same-store sales expansion. The retailer serves as a key barometer for consumer spending resilience.

CarMax earnings the same day will provide used car market insights. AutoZone, Cintas, and Accenture also report, offering perspectives across different economic sectors.

Market sentiment has shifted decisively toward risk assets following the rate cut. Cash outflows reached nearly $5 billion, marking the first weekly outflow since July as investors embrace equities over safe havens.

Energy markets bucked the trend despite easier financial conditions. Brent crude and West Texas Intermediate both fell over 1% Friday as OPEC+ production increases overshadowed rate cut benefits.

The oil market faces additional pressure from Saudi Arabia’s push for larger market share through higher output. Nuclear power stocks have rallied as data center electricity demands create new investment opportunities.

Friday’s PCE inflation data represents the first major test of market optimism since the Fed’s policy shift.