TLDR

- Whales bought 120M XRP during the recent market pullback.

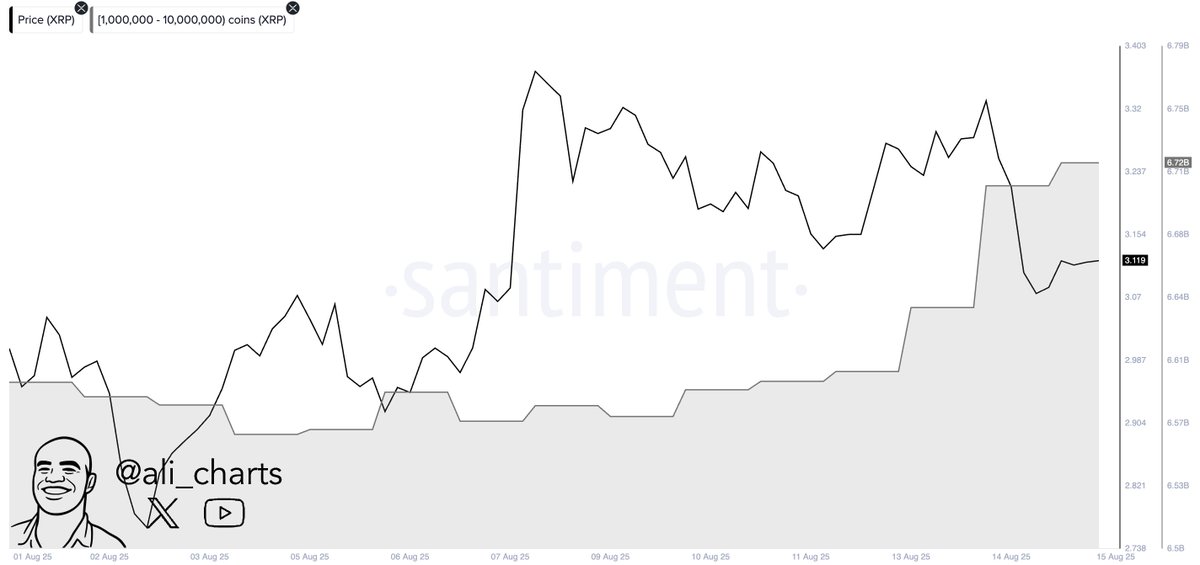

- Wallets with 1M–10M XRP have grown since early August.

- XRP price Key supports at $3.00, $2.85, and $2.64 remain intact.

- A move above $3.33 may trigger targets up to $5.85.

Large XRP holders increased their positions during the latest market pullback. On-chain data shows a purchase of about 120 million tokens. The buying coincided with a price rebound from recent lows. Analysts say XRP is now testing a critical support zone. A breakout may follow if buying pressure continues.

XRP Whale Accumulation Drives Support

Santiment data shows wallets holding 1 million to 10 million XRP have grown their balances since early August. Whales acquired about 120 million tokens during the dip. Historically, such phases often provide a price floor. Large holders tend to invest with longer-term strategies and significant influence.

The recent increase in whale holdings aligns with a rebound in the XRP price. The market recovered quickly after a brief pullback. Analysts note that whale buying helped limit further declines. This activity supports sentiment and attracts retail interest. Liquidity also remains steady during such periods.

XRP Price Technical Structure Points to Strong Support

Building on the earlier observation of whale accumulation, the daily XRP price chart shows an ABC correction nearing completion. The C-leg is testing the upper Ichimoku cloud. This level aligns with key supports at $3.00, $2.85, and $2.64. The zone combines historical breakout points and cloud structure. It often absorbs selling pressure.

A higher low above $2.85 would confirm the end of the correction. This could start a new impulsive wave. The first target is $3.33. Further moves could reach $4.36 and $5.85. These targets match common Fibonacci extensions. They also align with prior market reaction points.

The Breakout Path For XRP Price Remains Valid

In addition to the strong support, if XRP holds above $5.00 after a wave (iv) retracement, the next target is $10.47. This matches a 2.618 Fibonacci extension. It would complete a higher-degree wave count. Strong volume and rising On-Balance Volume would support the move. RSI must also hold bullish ranges.

A close below $2.64 would weaken the bullish view. This could trigger a deeper drop to the lower Ichimoku boundary. Such a move would disrupt the Elliott Wave count. It might delay any breakout.

Market Sentiment Linked To Whale Activity

Whale buying during dips supports retail confidence. It discourages panic selling. The recent 120 million XRP inflow signals strong investor conviction. It also reflects expectations for favorable developments. Possible factors include legal clarity and wider market recovery.

Large holders can also trigger corrections. Profit-taking near resistance levels can cause rapid price reversals. This can lead to volatility spikes. If the current trend continues, this accumulation could set the stage for a medium-term price breakout. Sustained whale interest typically creates a support base that can withstand market corrections, providing a foundation for bullish momentum