TLDR

- XRP rebounds from major support amid rising on-chain transactions.

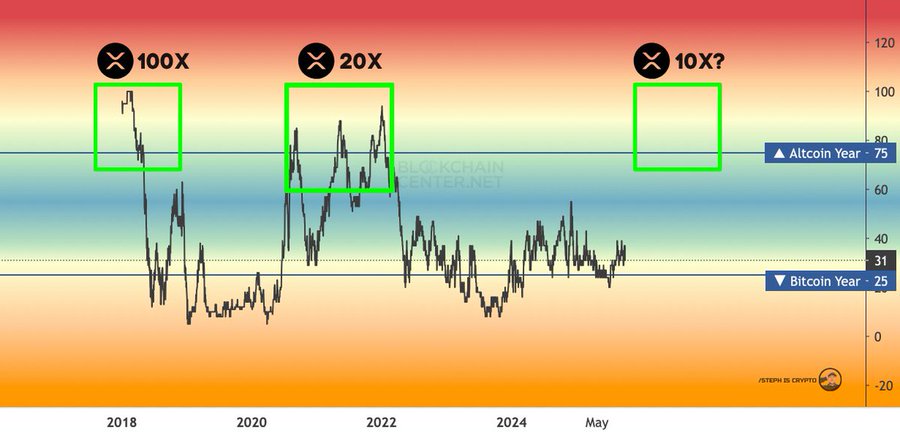

- Historical cycles show XRP’s rallies align with altcoin dominance phases.

- Analyst data suggests renewed accumulation phase supported by network activity.

Analysts are now highlighting XRP’s repeating performance patterns across past market cycles, suggesting that the cryptocurrency may be entering another critical phase. The data shows XRP’s historical rallies during previous altcoin cycles, with current trends aligning with those moments.

Historical Rallies Indicate Structured Market Behavior

According to the data, XRP achieved a 100x rally in 2017, followed by a 20x surge in 2021, with both periods occurring in the later stages of Bitcoin’s macro cycles. The chart suggests that XRP’s next significant move could align with a new market phase, potentially signaling another large-scale rally if historical patterns hold.

The visual data outlines three distinct growth zones marked by green boxes, representing XRP’s exponential growth phases over the past seven years. In 2017 XRP price skyrocketed by over 100 times in value, reaching its all-time high as the broader cryptocurrency market entered the final leg of the bull run. In 2021, the asset surged nearly 20 times, following a strong Bitcoin-led market recovery.

Currently, the analyst marks a third potential box which could mean a tenfold surge on the XRP price. The visualization underscores XRP’s historical tendency to follow strong altcoin cycles, particularly during what the chart identifies as “Altcoin Year” phases, currently marked at 75%, compared to the 25% Bitcoin Year reading.

XRP Price Makes Rebound from Key Support

Looking at data from daily charts, we see that the price currently trades near $2.62, reflecting a 3.67% daily gain, after rebounding from lows around $2.15 earlier this week. A descending trendline drawn from the July high near $3.20 acts as overhead resistance, while the $2.40–$2.50 zone (highlighted in blue) represents a significant support region where buyers have previously stepped in. This price area has served as a mid-term accumulation zone since August, with multiple successful defenses against downward pressure.

The volume oscillator, now at 1.25%, indicates moderate market activity, showing that while the rebound is supported by improving participation, momentum remains below peak levels seen during the July surge. The XRP price structure reflects consolidation beneath the long-term resistance line, suggesting a need for sustained volume above $2.80 to validate any bullish continuation.

Between June and October, the XRP price behavior shows a series of lower highs and higher lows, forming a tightening structure that could lead to a breakout if buying pressure builds. The most recent drop below $2.20 was short-lived, with the rapid recovery back above the support zone indicating continued interest among traders.

Transaction Data Points to Renewed Network Activity

On-chain metrics provide further context to XRP’s current positioning. Data from Artemis shows that daily transactions on the Ripple network have risen to 1.9 million, marking a 10.6% increase over the previous period. This level is among the highest since early August, when transaction counts last exceeded the 2 million mark.

Over the past two months, transaction activity had fluctuated between 1.2 million and 1.6 million, reflecting a period of relative stagnation as market volatility cooled. The recent uptick aligns with the rebound in XRP price action, indicating renewed on-chain utilization and potential network re-engagement from institutional or high-volume participants

While the data does not specify the nature of these transactions, the correlation between rising network throughput and short-term price stabilization suggests improving liquidity conditions. In prior cycles, similar transaction spikes were observed during early accumulation phases preceding stronger market rallies.