TLDR

- XRP saw a 7% price drop as long positions were liquidated in a 935% imbalance.

- Over 2.23B XRP tokens were dumped by whales, increasing market fear.

- XRP’s price fell from $2.60 to $2.41 amid heavy selling pressure.

- The $2.00 level is crucial for potential rebound after recent price drop.

XRP’s price took a sharp dive after a brutal liquidation event, with traders seeing over $8 million wiped out in just a few hours. This sudden crash left XRP bulls reeling as nearly 2.23 billion tokens were dumped by whales, contributing to a cascade of liquidations. The price, which had been holding steady above $2.60, now sits around $2.44, and fears of further declines are growing as the market’s imbalance intensifies.

XRP Bulls Face Massive Liquidation Imbalance

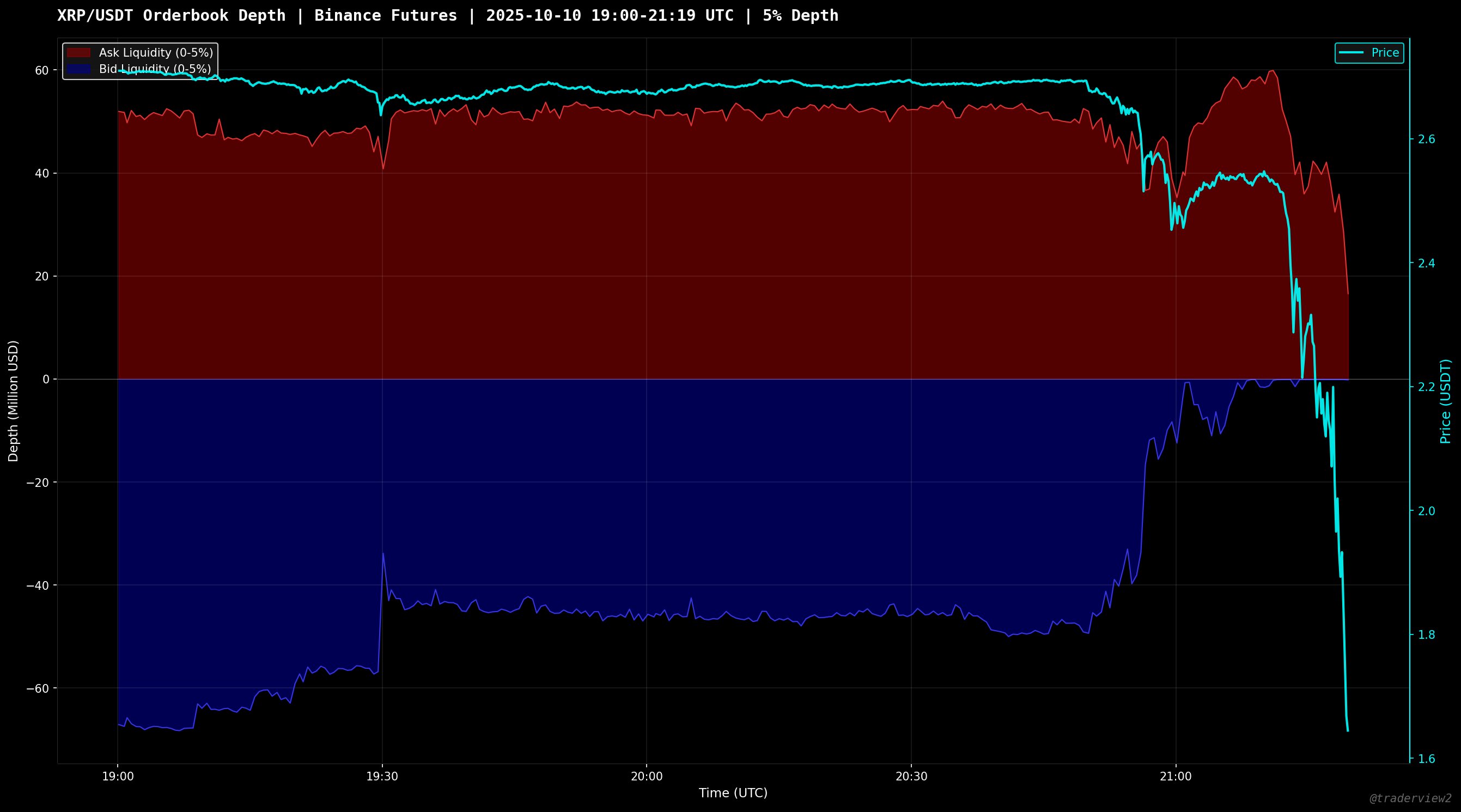

XRP’s recent price drop has been marked by a significant imbalance in liquidations, with long positions taking the brunt of the damage. According to data from CoinGlass, over $8.13 million in positions were liquidated in a four-hour window, with $7.34 million of that coming from long positions. This marks a 935% liquidation imbalance, a sharp contrast to short positions, which saw a minimal liquidation of just $785,000.

The ratio reveals the overwhelming pressure on bulls, who were caught in a wave of sell-offs as XRP’s price declined from over $2.60 to a low of $2.41 before settling at around $2.44. The rapid liquidation process pushed more long positions to close, compounding the downward movement. Meanwhile, short positions barely moved, indicating that sellers were in control without needing much leverage to dominate the market.

Whale Activity Contributes to Market Downturn

Whale activity has played a major role in XRP’s recent price struggles. On-chain data shows that over 2.23 billion XRP tokens were offloaded by large holders, further adding to market volatility. This massive distribution of tokens exacerbated the selling pressure and led to a deeper downtrend as XRP failed to defend the $2.72 support level.

The selling trend was marked by a shift in market sentiment, as major holders pulled out, triggering fear among smaller investors. The large-scale offloading created a liquidity crunch, making any short-term recovery seem increasingly unlikely. The cumulative effect of whale movements and the liquidation cascade has left XRP vulnerable to further downside risks.

Technical Indicators Signal Potential for Continued Decline

Technical indicators also paint a bleak picture for XRP’s short-term prospects. The cryptocurrency has been moving within a descending triangle pattern since late July, marked by lower highs and a stable horizontal base near $2.72. As of now, XRP trades at around $2.47, down over 5% in the past 24 hours. The recent decline below key support levels, including the $2.72 zone, confirms that bearish momentum remains intact.

The Parabolic SAR (Stop and Reverse) indicator further strengthens this negative outlook. With dotted markers appearing above the recent price candles, it suggests that the downtrend could persist in the near term. As the market struggles with lower trading volume, XRP’s price may test lower support levels around $2.00 before any potential rebound.

Support at $2 Remains Critical for Potential Reversal

The $2.00 to $2.39 zone is now a critical support area for XRP, as it has historically acted as a strong point of rebound following previous declines. While some traders hope for a recovery in this range, the current market conditions suggest that the selling pressure remains heavy. The dominance of Taker Sell orders, as indicated by Spot Taker CVD data, shows that market sellers are still in control, while buyers are hesitant to increase exposure.

If the $2 support level holds, there may be a chance for a short-term recovery towards the $2.72 resistance zone. However, failure to maintain support at $2 could lead to further declines. With whale activity still dominating the market and technical indicators pointing to bearish momentum, XRP’s future trajectory will largely depend on whether buyers can regain control at this crucial level.