TLDR

- World Liberty Financial acquired 3,473 ETH for $13 million on July 22, 2025.

The project’s total ETH holdings are now around 73,616 ETH, valued at $275.9 million.

Ethereum ETFs saw over $500 million in inflows, indicating rising institutional interest.

The company is preparing for the upcoming launch of its WLFI token in the next two months.

World Liberty Financial, a crypto initiative linked to former U.S. President Donald Trump, has purchased over 3,400 Ethereum (ETH) tokens for a total of $13 million. This acquisition, which took place on Tuesday, signals growing interest from institutional investors in Ethereum as the cryptocurrency gains more attention in the market.

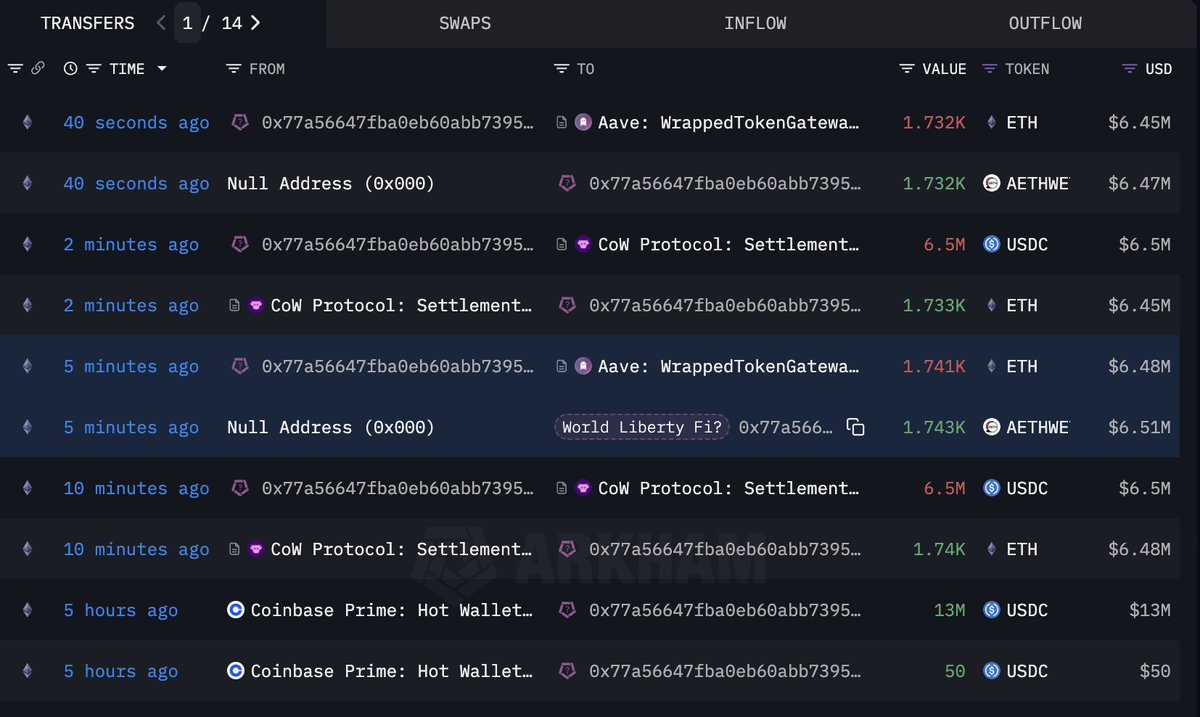

According to data from Arkham Intelligence and reported by Lookonchain, the crypto project acquired a total of 3,473 ETH at an average price of $3,743 per token. The ETH was purchased across several wallets and subsequently staked on Aave, a decentralized finance (DeFi) platform, as part of the company’s strategy to maximize its investment.

Growing Interest in Ethereum from Institutional Investors

World Liberty Financial’s move comes amid a surge in institutional interest in Ethereum. On the same day that the company made its purchase, Ethereum exchange-traded funds (ETFs) saw $533.9 million in net inflows.

This marks a significant increase in investment activity within the Ethereum ecosystem. In comparison, Bitcoin ETFs experienced a net outflow of $67.9 million, as reported by SoSoValue data.

Ether’s price has been steadily climbing, reflecting this growing interest. Over the past week, the price of Ethereum rose by 20%, and it has gained 67.1% over the past 30 days. Despite a period of flatness in the last 24 hours, Ethereum’s increasing value has made it an attractive asset for both retail and institutional investors.

World Liberty Financial’s ETH Holdings and Staking Strategy

With the latest purchase, World Liberty Financial’s total ETH holdings now amount to roughly 73,616 ETH, which is valued at around $275.9 million based on current market prices. The company’s strategy involves not just holding but also staking its ETH holdings on Aave to earn rewards and maximize returns.

Staking is a key feature in the DeFi space, where investors lock up their tokens in a protocol to receive rewards in the form of additional tokens.

By staking its ETH on Aave, World Liberty Financial positions itself to benefit from this emerging financial ecosystem. The project’s involvement in DeFi aligns with its broader goals of expanding its reach in the crypto world.

Preparation for WLFI Token Launch

Alongside its recent Ethereum acquisition, World Liberty Financial is preparing for the upcoming launch of its own token, WLFI. The company announced last week that it is aiming for a launch within the next two months.

The WLFI token is expected to begin trading in the coming weeks, marking a significant milestone for the project.

“We’re targeting 6 to 8 weeks for the full awakening — strategic alignments (alliances, grand stages, smart unlocks) take time to realize full potential,” said the project team in a statement.