TLDR

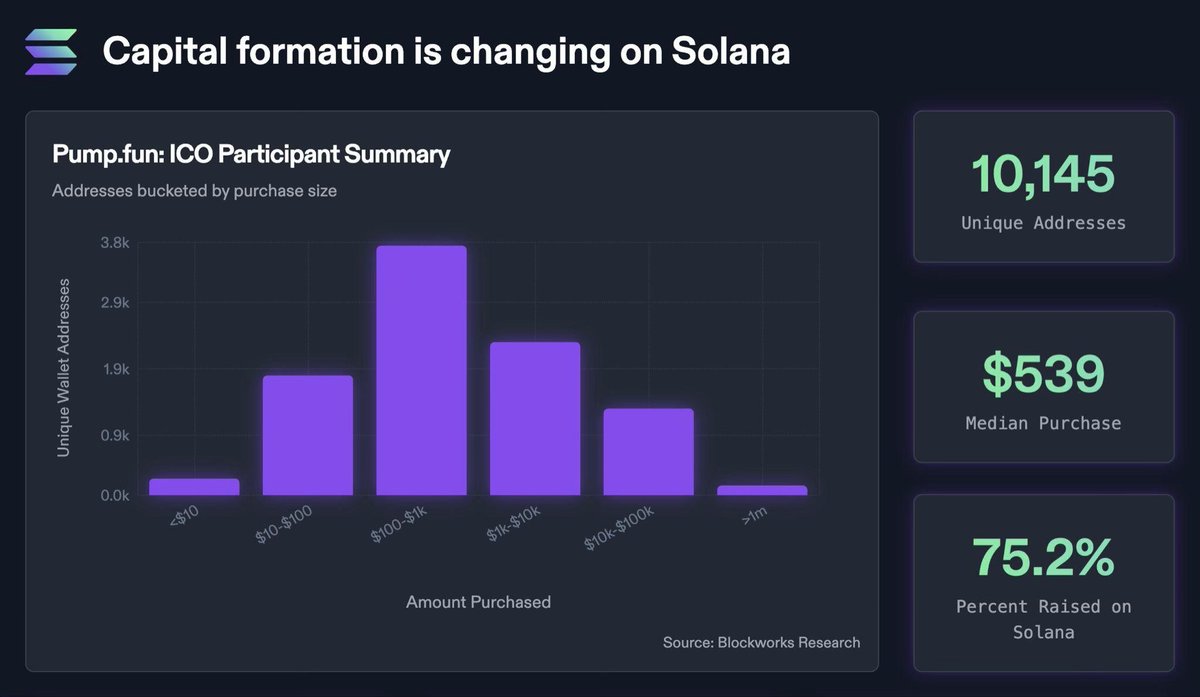

- Solana raised $600M in 12 minutes via Pump.fun, with 75.2% of funds processed directly on-chain.

- Over 10,000 unique wallets joined the Pump.fun ICO, with an average contribution of $539.

- A symmetrical triangle pattern on Solana’s chart signals a possible breakout toward the $200–$400 range.

- Daily active addresses on Solana neared 16 million as institutional inflows hit $78 million.

Solana (SOL) is gaining momentum as a powerful chart pattern and a record-breaking on-chain fundraising event spark renewed bullish sentiment. With over $600 million raised through Pump.fun and more than 10,000 wallets participating, investor interest is rising. As SOL trades near a key resistance point within a symmetrical triangle, many are now focused on a possible breakout toward the $200 level and higher price targets.

Solana Price Symmetrical Triangle and Bullish Setup

A symmetrical triangle pattern has formed on Solana’s daily price chart, showing a steady narrowing between support and resistance levels. This technical setup is typically neutral until a breakout occurs.

At present, Solana is trading just below the upper boundary of the triangle, with price volatility compressing and signaling a potential breakout. The pattern has developed over an extended period and is now approaching its peak.

If Solana breaks above the triangle with strong volume, analysts see the next immediate target around the $200 level. This zone represents a key psychological mark and aligns with earlier resistance seen in previous price movements.

A sustained move above $200 could open the path toward higher levels, including the $375 to $400 range if momentum continues.

With decreasing volatility and growing on-chain strength, this pattern may act as the starting point for a large directional move. Traders are now closely tracking volume and price behavior near resistance.

Pump.fun Raises $600 Million Through Solana

On July 15, Pump.fun hosted a decentralized token offering that raised $600 million in just 12 minutes. The entire process happened on the Solana blockchain without support from banks, brokers, or other third parties. This fundraising was one of the largest community-based events in recent blockchain history.

The event took place during off-market hours, while traditional finance markets were closed. Solana’s on-chain capabilities allowed it to handle a large number of transactions with no delays. The event’s speed and size showed the efficiency of Solana’s infrastructure when managing high traffic.

In a post on X, the Solana team said, “$600 million raised, no bankers, no middlemen—just Solana.” The event showed how Solana can be used for capital formation without relying on centralized financial systems.

Over 10,000 Wallets Join Fundraising, Showing Broad Retail Support

According to data from Blockworks Research, 10,145 unique wallet addresses joined the ICO. The majority of participants contributed between $100 and $1,000, while the average amount invested was $539. This showed that the offering attracted grassroots users rather than large institutions.

Only a few wallets contributed more than $100,000, which pointed to a wider distribution of ownership. The structure of this raise differed from traditional capital raises, where a small group of investors often controls a large share.

The strong turnout and balanced contributions helped avoid capital concentration. This type of participation has become more common in blockchain fundraising, where small investors are given access to early-stage projects.

Majority of Funds Raised Directly Through Solana Blockchain

According to the latest data, 75.2% of the $600 million raised through Pump.fun was contributed directly on the Solana blockchain. This highlighted a shift toward on-chain capital formation, powered by Solana’s scalable infrastructure. The network processed thousands of transactions smoothly, without the need for banks or intermediaries.

The on-chain process ensured full transparency, as every contribution was recorded and visible in real-time. This allowed investors to track transactions live, building trust and reducing reliance on centralized systems. Solana’s ability to handle high-volume activity has strengthened its use in decentralized fundraising efforts.

Alongside this development, Solana’s price is nearing the top of a symmetrical triangle pattern on the daily chart. If SOL breaks above the resistance and maintains strong volume, a move toward the $200 level could follow.

With institutional inflows reaching $78 million and active addresses climbing to 16 million, buying momentum may continue, setting up potential targets between $200 and $400.