TLDR

- Ethereum’s whale activity spiked, with 270,000 ETH accumulated, signaling strong bullish sentiment.

- Institutional ETFs raised $900M, boosting Ethereum’s price momentum and market confidence.

- Over 26% of Ethereum’s supply is staked, tightening liquidity and driving price growth.

- Ethereum faces key resistance at $3,270; breaking it could target $3,500 next.

Ethereum’s price has recently surged to new highs, largely driven by whale activity, institutional interest, and the anticipation of spot ETF approvals. With Ethereum approaching key resistance levels, many investors are wondering if this upward momentum will continue. As whales accumulate and institutional investors make their moves, Ethereum’s price could potentially target the $3,500 mark.

Ethereum Whale Activity Sparks Market Optimism

Institutional interest in Ethereum has surged, with notable whale activity playing a pivotal role in the cryptocurrency’s price movement. Sharplink Gaming, the largest holder, recently accumulated 270,000 ETH, surpassing prominent holders like the Ethereum Foundation. This accumulation is seen as a strong signal that large investors are positioning themselves for Ethereum’s continued growth.

Recent data from IntoTheBlock shows a significant increase in large-holder netflows, jumping from 14,590 ETH to 88,180 ETH in just 24 hours. This spike in whale purchases demonstrates rising market confidence in Ethereum’s long-term prospects. As whales accumulate more ETH, it bolsters the belief that the price could rise significantly in the coming weeks.

With both institutional and whale participation, Ethereum is poised to see upward momentum. The market optimism surrounding these large investments could potentially push Ethereum toward its next major price target of $3,500 or even higher, further solidifying its position as a leading cryptocurrency.

Institutional Investments and ETF Inflows Strengthen Bullish Sentiment

Ethereum has seen significant price growth, driven by institutional interest and market dynamics. U.S. Ethereum ETFs recently had their best week, attracting over $900 million, fueled by optimism surrounding new staking regulations. This highlights strong institutional confidence in Ethereum’s future, supporting a bullish outlook.

The futures market is also contributing to Ethereum’s price movement. Data from Coinalyze shows rising Ethereum futures open interest and positive funding rates, indicating more traders are betting on price increases. This aligns with the short squeeze narrative, confirming market strength and boosting expectations of further growth.

Staking optimism is another key factor behind Ethereum’s rally. Over 26% of the total ETH supply is locked in staking contracts, reducing liquid supply. If U.S. spot Ethereum ETFs are allowed to stake, the staked percentage could grow, tightening supply further and driving prices higher. Currently, Ethereum is priced at $3,233, up 8.22% in the last 24 hours.

Ethereum’s Price Outlook as Key Resistance Levels Are Tested

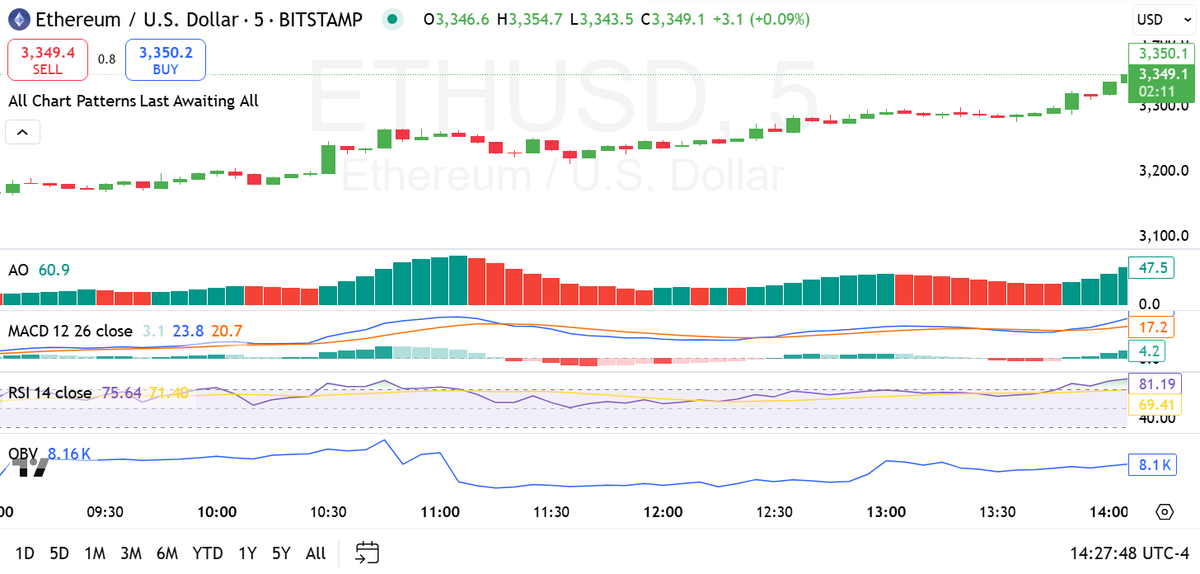

Ethereum has been on an impressive upward trajectory, breaking through multiple resistance levels as buying pressure intensified. The price has risen from around $3,160 to a recent high of $3,273, with strong bullish momentum behind it.

The Awesome Oscillator (AO) indicates positive momentum, while the MACD and RSI further confirm the upward trend. The sharp surge in price in recent hours reflects strong buying interest in the market.

Currently, Ethereum is facing resistance at around $3,270, and a breakout above this level could signal the start of the next phase of its bull run. If the price manages to overcome this resistance, the next key target for bulls would be the 161.8% Fibonacci level around $3,700. This price level is seen as a major resistance point, and overcoming it would signal further bullish momentum.

The on-balance volume (OBV) supports the bullish outlook, showing an increase in inflows into Ethereum. If this trend continues, a rally to $3,500 is highly possible, further solidifying the bullish sentiment in the market.