TLDR

- Ethereum price is approaching key resistance, potentially signaling a breakout to new highs, including a $10,000 target.

- The sharp price increase since mid-2023 suggests significant accumulation, likely driven by institutional investors.

- Ethereum’s continued technological upgrades, like Ethereum 2.0, could help maintain its upward trajectory toward $10,000.

- Ethereum’s growing role in decentralized finance and NFTs may increase demand, fueling its price rise toward $10,000.

Ethereum price has followed a clear upward channel over the years. The chart, spanning several years, shows its price action against the U.S. Dollar with 3-week candlesticks. The main feature is an upward-sloping channel marked by parallel yellow lines.

This channel has been a reliable guide, signaling Ethereum’s bullish trajectory. The price movements have consistently respected the channel’s boundaries. Recently, however, volatility has increased, particularly near the channel’s upper limit. This suggests Ethereum may be approaching a critical turning point.

Ethereum Price Momentum Suggests a Breakout Ahead

Ethereum price shows increased volatility near the upper channel boundary, signaling a potential breakout. The strong bullish trend since mid-2023, with rising highs and higher lows, supports continued upward momentum. As the price nears the channel’s upper limit, a breakout seems likely, pushing Ethereum’s value higher.

ETH/USD 3W Chart | Source: X

The recent surge in price indicates heavy accumulation, possibly driven by institutional investors. The ongoing rise and increased buying activity reinforce Ethereum’s position in an accumulation phase. Market sentiment remains positive, suggesting that Ethereum price will continue to align with the broader growth in the crypto market.

Ethereum Price Faces Key Resistance Levels

Furthermore, Ethereum price is testing the upper boundary of its ascending channel. This level may act as a key resistance point. If Ethereum breaks through, a strong bullish move could follow. A breakout above the channel’s resistance could drive Ethereum toward new all-time highs.

However, if Ethereum fails to break the resistance, a correction or consolidation is possible. In this case, support could form at the lower part of the channel. A period of consolidation might allow Ethereum to regain momentum. Traders should closely watch the resistance level for signals on Ethereum’s next move.

Broader Market Dynamics and Long-Term Growth

Following on key price action, Ethereum is testing the upper boundary of its ascending channel. This level may act as a key resistance point. If Ethereum breaks through, a strong bullish move could follow. A breakout above the channel’s resistance could drive Ethereum toward new all-time highs.

However, if Ethereum fails to break the resistance, a correction or consolidation is possible. In this case, support could form at the lower part of the channel. A period of consolidation might allow Ethereum to regain momentum.

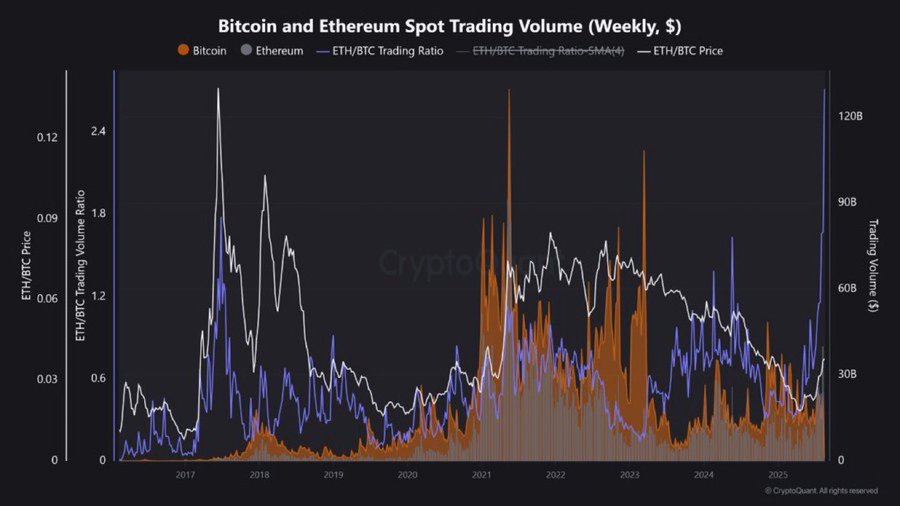

ETH Trading Volume Indicate Strong Sentiment

Moreover, it’s worth examining the recent trends in Ethereum’s trading volume and market sentiment. Ethereum’s trading volume has consistently increased, especially in correlation with its growing use cases in DeFi and NFTs. This surge in trading activity suggests strong investor interest, which typically precedes significant price movements.

If Ethereum continues to see this level of volume, its price could be propelled higher, aided by the continuous entry of both retail and institutional investors.

BTC/ETH Trading Volume Chart | Source: X

Ethereum’s relative strength compared to Bitcoin is also an important factor. The ETH/BTC trading ratio has shown significant fluctuations, with Ethereum gaining ground during periods of increased market activity.

This suggests that, while Bitcoin may dominate the broader market, Ethereum’s growing influence and adoption are starting to be recognized. If the ETH/BTC ratio continues to rise, it could indicate that altcoins are becoming more dominant.