TLDR

- Franklin Templeton’s Form 8-A filing brings its XRP ETF closer to listing on NYSE Arca.

- The Form 8-A filing follows the S-1 amendment, placing the XRP ETF’s launch between November 24 and December 1.

- XRP ETF competition intensifies with firms like Bitwise, 21Shares, and Grayscale entering the market.

- The filing marks a pivotal step toward Wall Street’s greater involvement with XRP in ETF products.

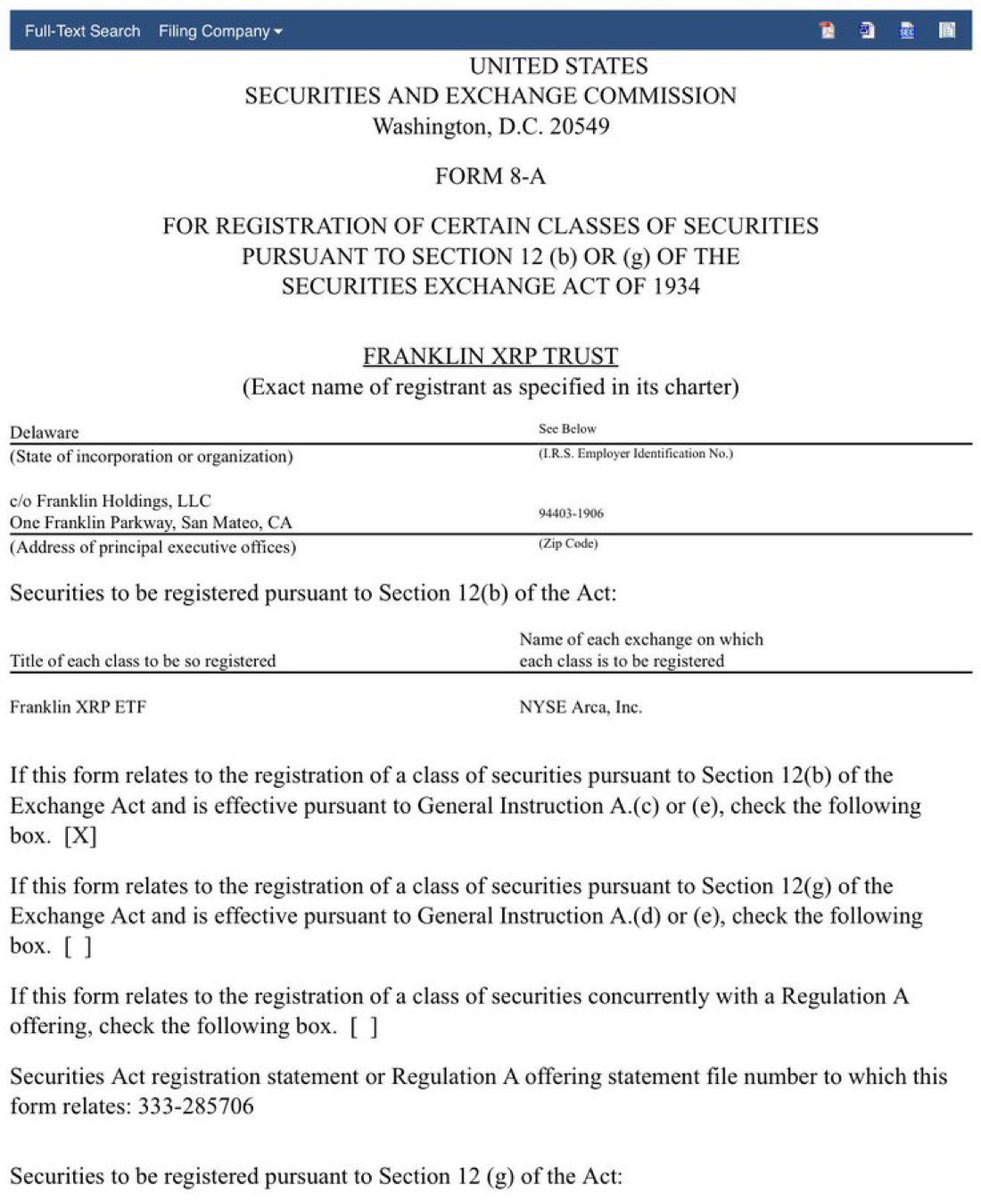

Franklin Templeton has filed a crucial Form 8-A with the U.S. Securities and Exchange Commission (SEC), advancing its efforts to launch the highly anticipated Franklin XRP ETF. This filing, registering the ETF for listing on NYSE Arca, is one of the final steps before the fund can begin trading. The move has sparked significant interest in the rapidly growing market for XRP exchange-traded funds (ETFs), which has seen several major players entering the space.

Form 8-A Filing Marks Key Step in the Process

The Form 8-A filing officially registers the Franklin XRP ETF under Section 12(b) of the Securities Exchange Act, making it a key procedural move before an exchange listing. This filing comes after an amendment to the firm’s S-1 document, which removed previous language that allowed the SEC to delay approval. This update triggered a 20-day countdown for approval, which places the earliest possible launch window for the ETF between November 24 and December 1.

Although some earlier reports suggested the ETF might launch as early as November 18, the updated timeline indicates a slight delay. Analysts view this as a standard part of the regulatory process, with the delay not reflecting any significant setbacks. The market now expects a busy period in late November and early December as the XRP ETF landscape gains momentum.

Increasing Competition in the XRP ETF Space

Franklin Templeton is entering a competitive market, as several major financial institutions are also preparing to launch their own XRP ETFs. On November 13, Canary Capital launched the first U.S. spot XRP ETF, which recorded strong interest with over $58 million in day-one volume. Other firms such as Bitwise, 21Shares, Grayscale, and WisdomTree are also preparing their XRP ETF products, setting the stage for one of the most competitive rollouts of the year.

As a $1.5 trillion asset manager, Franklin Templeton is well-positioned to quickly challenge Canary Capital’s early lead. Analysts note that Franklin’s deep relationships with institutional desks and wealth platforms could lead to higher allocations once the product is live. These connections are expected to be especially significant during quarterly rebalancing periods, where institutional investors may increase their exposure to the XRP ETF.

Community Reactions and Market Sentiment

The filing has sparked a range of reactions within the XRP community. While some users are excited about the arrival of another major player in the XRP ETF space, others have expressed frustration at the perceived “last-minute” nature of the move. Some members of the community pointed out that large asset managers prefer to follow a strict procedural process, which often results in delayed launches.

At the same time, there is optimism that the entry of multiple XRP ETFs will increase market liquidity and attract new inflows of capital. With XRP trading in the $2 range and exchange reserves decreasing, many expect that the launch of these ETFs could lead to a re-rating of the asset’s price. The arrival of institutional products may tighten the available supply of XRP, potentially fueling further demand.

XRP ETF Race Approaches Final Stages

With Franklin Templeton’s filing, the race to launch XRP ETFs has entered its final stages. The SEC’s approval process for these products is nearing completion, with heavy market activity expected in the coming weeks. Whether Franklin’s ETF launches by November 24, December 1, or slightly later, it is clear that the firm is positioning itself to become a major player in the growing XRP ETF market.

As the rollout of XRP ETFs accelerates, the involvement of major financial institutions like Franklin Templeton signals that XRP is approaching a new chapter. With Wall Street’s increasing interest in the digital asset, its future may become more closely tied to institutional demand and regulatory approval, setting the stage for a new phase of growth in the XRP market.