TLDR

- Ethereum surged 41.79% in two weeks, rising from $3,360 to over $4,700 and breaking key resistance levels.

- RSI entered overbought territory, with buying pressure fueled by Eric Trump’s “buy the dips” tweet.

- ETH price retest mirrors past cycles, with projections targeting $10,000 by 2025.

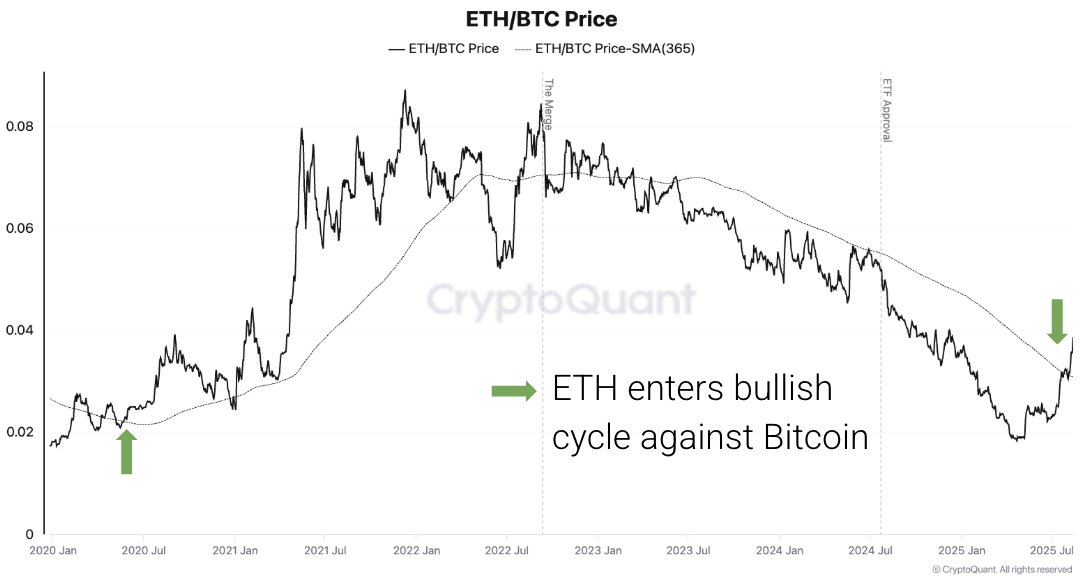

- ETH/BTC ratio broke above 365-day SMA, marking Ethereum outperformance over Bitcoin.

Ethereum (ETH) has experienced a significant surge in price, with the cryptocurrency’s value increasing by 40% in just two weeks. This rally has garnered attention from investors and analysts, following a series of factors contributing to Ethereum’s upward momentum.

The recent surge has been marked by increased buying pressure, particularly as Ethereum broke key resistance levels, signalling a potential continuation of its bullish trend.

Ethereum Price Recent Price Surge

Ethereum price surged from around $3,360 on August 2nd to over $4,700 by August 15th. This marks a $1,411.97 increase, or 41.79%. The rapid rise has caught the crypto community off guard. Notably, the crypto has broken past previous resistance levels. Technical analysis indicates the asset is currently in a strong bullish phase.

The surge follows Ethereum’s relative strength index (RSI), which moved into overbought territory, suggesting further price increases if buying pressure persists. A major catalyst for this rally was a tweet from Eric Trump, urging investors to “buy the dips” when Ethereum price was lower. His message sparked widespread investor interest, leading to a rapid price increase.

Market Outlook and Long-Term Growth Potential

Following the analysis, Ethereum price movement mirrors past cycles. Analysts highlight that Ethereum typically sees significant upward shifts after retesting key support levels. For example, in 2020, after finding support around $100, Ethereum surged 20x. The recent retest at $1,550 in 2023 suggests Ethereum could be gearing up for another bullish phase. Projections suggest it may target $10,000 by 2025.

- ETHUSD 1W Chart | Source: X

Ethereum’s growing adoption in the blockchain ecosystem, especially within DeFi, sets the stage for long-term growth. As institutional capital flows in and Ethereum’s use cases expand, higher price targets become more likely. Market maturation, along with Ethereum’s technical upgrades, positions the asset for continued appreciation in the months and years ahead.

Ethereum’s Outperformance Against Bitcoin

In addition, Ethereum’s recent performance against Bitcoin (BTC) enhances its price growth potential. The ETH/BTC price ratio has surpassed its 365-day moving average (SMA), signaling a bullish trend. This pattern has historically marked the start of bullish cycles for Ethereum, notably during the 2017 and 2021 altcoin seasons.

- ETHBTC 8H Chart | Source: X

The shift in the ETH/BTC ratio indicates that the altcoin is gaining ground against Bitcoin. This is a key sign of Ethereum’s growing market dominance. The altcoin breaking through its 365-day SMA is noteworthy. Historically, similar moves have led to Ethereum outperforming Bitcoin. Investors are closely monitoring this trend. Given the current market conditions, the crypto’s momentum could signal the start of a strong rally.