TLDR

- Nearly $500M in leveraged positions were liquidated in the last 24 hours, with 78% being long positions.

- Bitcoin fell 2%, dropping from an all-time high of $123,218 to $116,250, amid profit-taking.

- BTC’s exchange netflow turned positive, signaling increased selling pressure across crypto markets.

- US CPI data expected to rise 2.7% YoY in June, potentially strengthening the USD and reducing crypto risk appetite.

The cryptocurrency market experienced a broad pullback on Tuesday as traders took profits following a strong rally last week. This market correction comes ahead of the much-anticipated release of the US Consumer Price Index (CPI) data later in the day. The dip in prices has left major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and other popular altcoins, trading in the red.

Crypto Market Faces Pullback Amid Profit-Taking Ahead of CPI Data

In the past 24 hours, nearly $500 million in leveraged positions were liquidated across crypto markets, according to data from Coinglass. Of these liquidations, 78% were long positions, highlighting that investors who had bet on price increases were forced to sell their holdings.

Major cryptocurrencies such as Bitcoin, Ethereum, Solana (SOL), and Ripple (XRP) saw notable declines, following Bitcoin’s lead.

Bitcoin, which reached an all-time high of $123,218 just a day earlier, fell by around 2%, dropping to $116,250 during the European session. Altcoins, including Cardano (ADA) and meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), followed a similar downward trend. Traders appear to be locking in profits after the recent rally, increasing the selling pressure across the market.

BTC Inflows Contribute to Selling Pressure

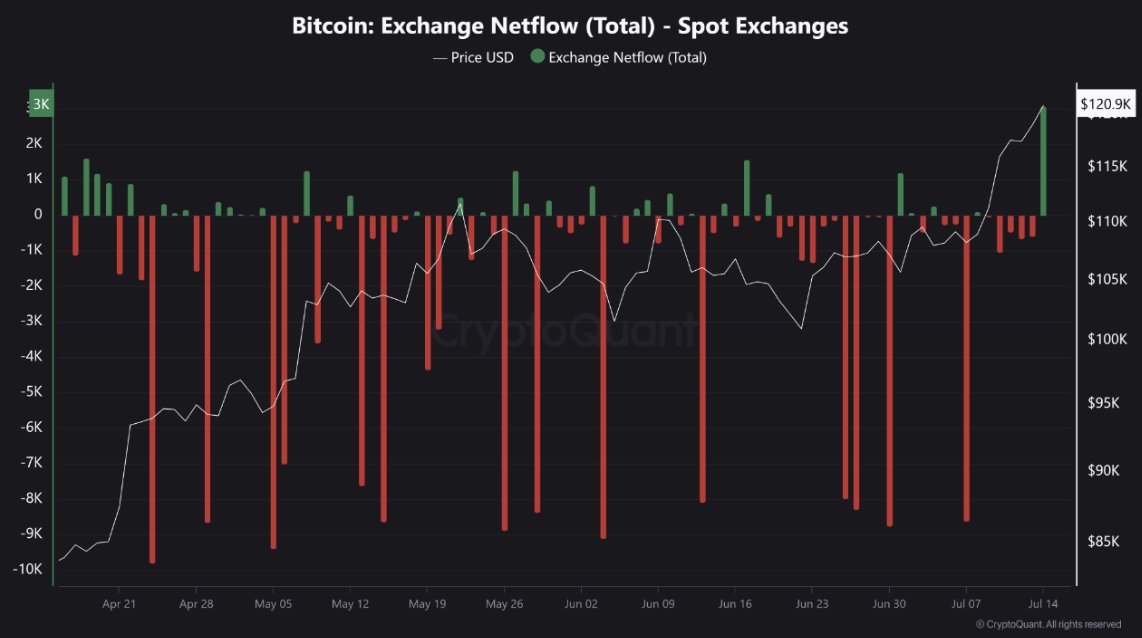

The market correction also appears to be influenced by rising Bitcoin inflows. According to CryptoQuant data, Bitcoin’s Exchange Netflow has turned positive, reaching levels not seen since February.

Positive netflow means more BTC is being sent to exchanges, which could indicate that investors are preparing to sell their holdings.

Additionally, Lookonchain reports that a dormant Bitcoin wallet holding 80,009 BTC worth approximately $9.46 billion transferred 7,843 BTC to Galaxy Digital. This move adds to the selling pressure as Galaxy Digital deposits the BTC on exchanges such as Binance and Bybit.

These developments are contributing to the broader market correction and raising concerns over further downward price movements.

Investor Caution Grows Ahead of US CPI Data Release

Investor caution is rising ahead of the release of the US Consumer Price Index (CPI) report later today. Inflation in the US is expected to rise at an annual rate of 2.7% for June, an increase from May’s 2.4%.

The core CPI, which excludes food and energy, is forecast to rise by 3% YoY. This is up from the previous month’s 2.8%, signaling a potential uptick in inflation.

If the CPI data comes in higher than expected, it could strengthen the US Dollar (USD) and dampen investor sentiment toward riskier assets like cryptocurrencies.

🚨BREAKING🚨

US CPI 2.7%

ABOVE expectations for the first time in 5 months pic.twitter.com/fQuoPrWOpZ

— Quinten | 048.eth (@QuintenFrancois) July 15, 2025

Conversely, a softer-than-expected CPI could boost expectations of future interest rate cuts by the Federal Reserve (Fed), which could support the demand for risk assets, including cryptocurrencies.

This uncertainty surrounding the CPI data release is likely contributing to the current cautious mood in the crypto markets.

Market Volatility Intensifies with $500 Million in Liquidations

The overall crypto market has experienced a wave of liquidations, with over 130,000 traders affected in the past 24 hours. Liquidations occur when traders are forced to close positions due to price fluctuations.

As a result, the total liquidation value reached nearly $500 million. Long positions made up the majority of liquidated trades, indicating that many traders had anticipated further price increases but were caught off-guard by the sudden market correction.

The combination of rising Bitcoin inflows, profit-taking behavior, and caution before the US CPI release has created a volatile environment in the crypto market. Investors are closely watching the CPI data, as it could set the tone for market sentiment in the coming weeks.

As the crypto market navigates this short-term correction, traders will likely remain focused on the broader macroeconomic landscape, including inflation data, interest rateexpectations, and the ongoing performance of major cryptocurrencies.