TLDR

Solana’s spot ETF approval could happen as early as July 2025, with a 90% chance, per Bloomberg’s Eric Balchunas.

SEC may include staking in Solana ETFs, providing investors with yield opportunities for the first time.

The Solana ETF race intensifies as firms like VanEck and Bitwise prepare updated filings to capture the first-mover advantage.

Solana ETFs could lead an “Altcoin ETF Summer,” boosting institutional and retail interest in altcoin investments.

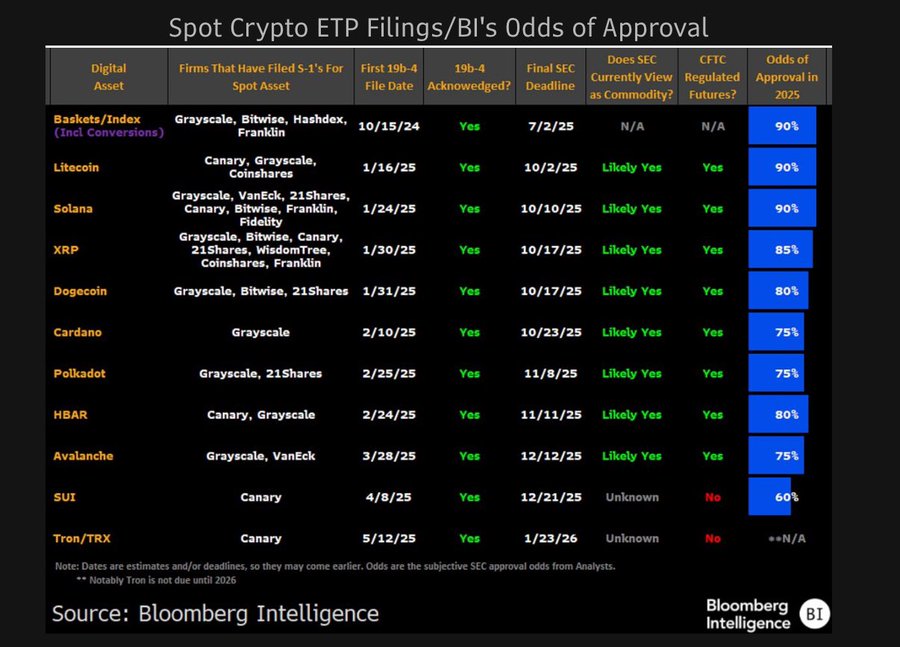

Bloomberg ETF analyst Eric Balchunas has projected that the chances for Solana ETF approval are extremely high, estimating a 90% likelihood of approval in 2025. This follows a series of developments where the U.S. Securities and Exchange Commission (SEC) fast-tracked the review process for several proposed Solana ETFs. The timeline suggests a potential approval as early as July 2025, signaling a significant shift in how regulators may treat altcoin ETFs.

SEC Moves to Fast-Track Solana ETF Proposals

The SEC has reportedly requested that firms submit updated S-1 filings for SOL exchange-traded fund (ETF) proposals. This request indicates that the regulatory body is accelerating its decision-making process, with some analysts predicting approval as early as July. Issuers, including major asset management firms such as Grayscale, Bitwise, and VanEck, are expected to resubmit filings within the next week.

The move to expedite the review process is a critical sign that the SEC is seriously considering approval of Solana ETFs. Bloomberg’s Eric Balchunas indicated that the chances of approval for a SOL ETF are now pegged at 90%. This aligns with a similar outlook for other altcoins such as Litecoin, which also shows high probabilities for approval.

“SOL, along with other altcoins, has a high chance of gaining approval,” Balchunas noted. He expects that spot ETFs for Solana, as well as other cryptocurrencies like XRP, could hit the market in the coming months. His analysis points to a possible “Altcoin ETF Summer” where several altcoin spot ETFs could receive approval in rapid succession.

Staking in Solana ETFs: A Potential Game-Changer

One notable element under consideration for Solana ETFs is the integration of staking. Staking allows investors to earn rewards by supporting the Solana blockchain network. The SEC’s current review includes discussions on whether staking can be included in these funds. If allowed, staking could provide Solana ETF investors with a new avenue to earn yields, adding a competitive edge to these products.

The prospect of staking within SOL ETFs contrasts with previous regulatory stances, where similar mechanisms were excluded from other cryptocurrency ETFs. The SEC’s willingness to explore staking as part of the investment structure signals an evolving regulatory approach, which could shape the future of crypto ETFs.

Sources close to the matter have confirmed that the SEC is in ongoing discussions with ETF sponsors about the inclusion of staking, suggesting that the regulatory body is open to the idea. If staking is approved, it could make Solana ETFs more attractive to investors seeking yield generation opportunities alongside their exposure to the cryptocurrency market.

Growing Market for Solana ETFs

The approval of SOL ETFs would mark a significant milestone in the crypto market, following the SEC’s approval of spot Bitcoin and Ether ETFs in the previous year. As interest in cryptocurrency continues to grow, the approval of altcoin ETFs like Solana could attract more institutional and retail investors to the space.

Market observers have noted that companies with exposure to Solana saw notable gains following news of the SEC’s review process. Stocks of firms such as DeFi Development Corp. and SOL Strategies rose by significant percentages, reflecting growing investor confidence in the potential approval of Solana ETFs.

With firms like VanEck, 21Shares, and Bitwise leading the charge, competition to launch the first Solana ETF is intensifying. As these firms refine their S-1 filings in anticipation of SEC feedback, they are also exploring different strategies to gain a first-mover advantage in the market. These companies are racing to bring Solana ETFs to market, hoping to capture investor interest before competitors can act.