Bitcoin reached a new all-time high, surpassing $112,000 on July 9, 2025, after briefly touching $112,152. This surge comes just months after the previous record of $112,000 in May 2025. The price movement reflects a broader shift in both market sentiment and political policy, providing a significant boost to Bitcoin’s value.

Policy Shifts Drive Bitcoin’s Price Surge

The increase in Bitcoin’s value has coincided with a change in U.S. policy. Recently, U.S. Treasury Secretary Scott Bessent announced a delay in the tariffs set to affect countries without trade agreements with the United States. Initially set to take effect in April, the tariffs will now begin on August 1, 2025.

This delay has helped ease market fears of imminent volatility, which has been a concern for investors in various asset classes.

Bitcoin’s price has also been influenced by growing support from high-profile individuals and institutions. Elon Musk’s recent announcement that his “America Party” will back Bitcoin has further strengthened the cryptocurrency’s position in the market. Additionally, institutional interest continues to rise, with many corporations increasingly adopting Bitcoin as a part of their treasury management strategies.

Institutional Adoption and Corporate Interest Boost Bitcoin

Bitcoin’s rally is further supported by institutional adoption. Companies and financial institutions have shown sustained interest in Bitcoin, helping to push its price higher.

According to reports, spot Bitcoin exchange-traded funds (ETFs) now manage close to $150 billion in assets. This figure highlights the growing acceptance of Bitcoin among major institutional investors.

Several tech companies have also been accumulating Bitcoin, positioning themselves as long-term holders. One notable example is The Smarter Web Company, a UK-based web design firm. The company transitioned into a Bitcoin treasury-focused entity and recently purchased an additional 226.42 BTC for $24.4 million. This move placed the company among the top 35 public holders of Bitcoin, further indicating the increasing corporate interest in the cryptocurrency.

Technical Indicators Suggest Further Bitcoin Gains

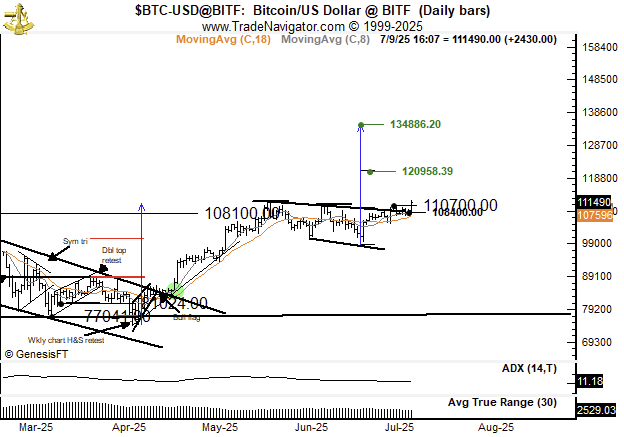

Bitcoin’s recent price movements align with technical indicators that suggest further upward momentum. One of the key patterns observed by analysts is the breakout of a “bull flag” on the charts.

This bullish continuation pattern typically predicts further price gains, potentially pushing Bitcoin’s spot price to new heights. According to one analyst, Bitcoin’s price could rise by another 30%, potentially surpassing $140,000 in the coming months.

Additionally, the price of Bitcoin has surpassed $111,000 and shows signs of continuing its upward trajectory. Veteran chart analysts like Peter Brandt believe that Bitcoin could see a further rise, potentially reaching $134,000. However, the continuation of this bullish trend depends on broader macroeconomic conditions and whether investor sentiment remains positive.

Increased Demand Continues to Drive the Market

Despite some volatility in the broader financial markets, demand for Bitcoin remains strong. The cryptocurrency has garnered attention from a variety of institutional investors, including asset managers, hedge funds, and corporations. The growth of Bitcoin ETFs and the acquisition strategies of companies such as The Smarter Web Company are indicators of this continued interest.

Bitcoin’s price growth also reflects a broader trend of digital assets becoming more integrated into traditional financial systems. As more companies and institutions incorporate Bitcoin into their portfolios, its long-term value proposition becomes clearer to a growing number of investors. The price movement over the past few weeks highlights how policy changes and institutional backing are playing a central role in Bitcoin’s ongoing rise.