TLDR

- Avalanche’s total trading volume reached $106.2B over 1,095 days.

- AVAX consolidates between $22 support and $42 resistance levels.

- Technical setup signals a potential 221% rally toward $75.

- Trading volumes peaked at nearly $3B by late 2025.

Avalanche (AVAX) continues to consolidate within a long-term symmetrical triangle pattern, showing structural resilience despite broader market fluctuations. The asset’s price action suggests tightening momentum between defined resistance and support zones, while ecosystem activity grows at an accelerated pace. Technical and on-chain indicators now converge, indicating that Avalanche may soon experience a decisive breakout after nearly three years of compression.

Avalanche Price Holds Between Key Levels

The monthly AVAX/USDT chart displays a clear symmetrical triangle formation stretching back to early 2022. This structure—defined by descending highs and ascending lows—represents a long consolidation phase after the all-time high near $146. Avalanche currently trades around $32, with resistance at $40–$42 and a support base between $22–$24. These levels have acted as critical reversal zones throughout the past two years.

AVAX/USD M Chart | Source: X

Long-term indicators show that AVAX has consistently defended its ascending trendline from the 2022 bottom, confirming investor accumulation at lower levels. The Ichimoku Cloud continues to limit upside moves, yet recent candles show repeated attempts to close above it. Converging 50-, 100-, and 200-day moving averages suggest an impending volatility breakout, where a strong close above $40 could mark the start of a macro trend reversal.

A Breakout Could Target a 221% Upswing

Furthermore, technical projections based on the triangle’s height indicate a potential 221% move toward the $72–$75 range if Avalanche confirms a breakout. This target also aligns with mid-channel resistance levels observed in the broader pitchfork structure derived from the 2021 top. Sustained momentum above this region could attract renewed institutional flows, with psychological resistance forming near the $100 mark.

In contrast, if Avalanche fails to maintain support near $22, price weakness could extend to the lower boundary around $15. Such a breakdown would invalidate the bullish setup and delay recovery. Even so, the long-term structure continues to favour consolidation over capitulation, signaling that traders are positioning for a directional move rather than exiting the market.

Ecosystem Trading Volume Continues to Expand

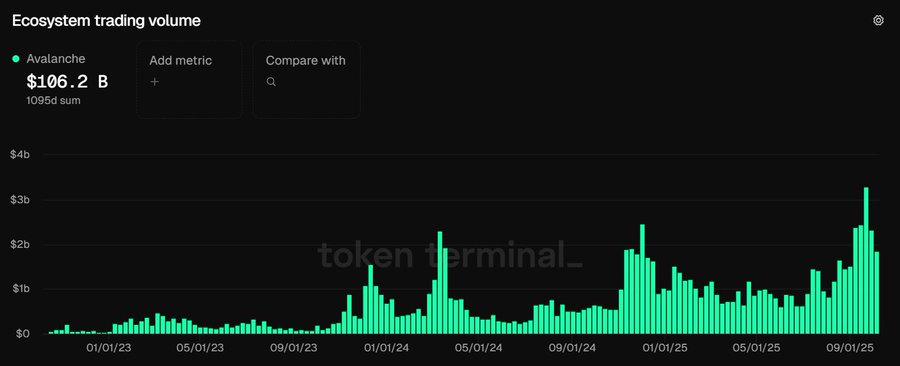

In addition, Avalanche’s on-chain trading activity has surged since early 2023, reflecting a sharp rise in ecosystem engagement. According to Token Terminal data, total ecosystem volume exceeded $106.2 billion across 1,095 days. This shift marks Avalanche’s evolution from a low-activity environment in 2023 to one of the most active Layer-1 ecosystems by late 2025.

Ecosystem Trading Volume Chart | Source: X

By early 2024, trading volumes began exceeding $2 billion monthly as decentralized finance (DeFi) platforms and subnet integrations expanded. Periodic surges in September 2024 and March 2025 saw daily volumes cross the $1.5–$2 billion range, demonstrating consistent market participation. The pattern of higher highs and higher lows indicates organic adoption rather than short-term speculation, suggesting that Avalanche’s network continues to mature.

Market Momentum Points Towards Continued Growth

Even so, from mid- to late 2025, Avalanche’s trading volume reached record levels near $3 billion. This increase corresponded with rising liquidity across decentralized exchanges (DEXs) and growing institutional presence in subnet development. Developers and investors appear to be leveraging Avalanche’s scalability and cost efficiency to build more complex financial ecosystems.

If this growth trajectory persists, Avalanche could strengthen its position among top-performing Layer-1 networks heading into 2026. The convergence of technical compression and ecosystem expansion indicates that the next directional move may be both significant and sustained—making AVAX a token to monitor closely as the crypto market prepares for its next liquidity cycle.