- Bitcoin price retests its ascending trendline, repeating prior crash signals.

- Insider wallet opens $150.9M long at $108K entry.

- RSI at 36.47 signals oversold conditions near $105K.

- Analysts divided as Bitcoin wavers between $100K and $135K.

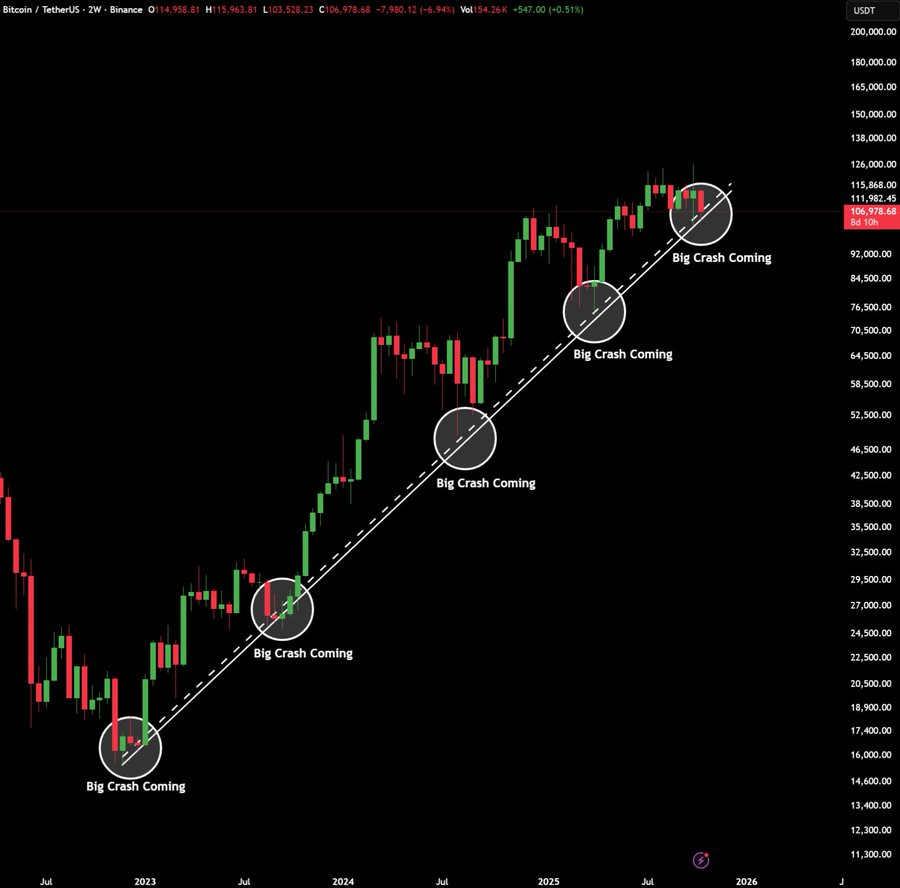

Bitcoin’s price structure has entered a decisive stage, with analysts warning of another potential big crash coming. This echoes patterns that preceded earlier corrections in 2023 and 2024. The remark coincides with a $150.9 million long position opened by an insider trader. This signals heightened uncertainty across the market.

Historical Patterns Suggest Possible Breakdown

Charts highlight Bitcoin’s long-term ascending channel, showing consistent upward movement since early 2023. However, each time the price approached the channel’s upper trendline, it was followed by a correction phase.

The trendline stretches from Bitcoin’s recovery zone around $16,000 in late 2022, connecting consecutive higher lows through mid-2023, early 2024, and mid-2025. Each intersection with the dotted support line has triggered major sell-offs. These past corrections, occurring around July 2023, March 2024, and May 2025, led to pullbacks of roughly 20%–30% before Bitcoin resumed its bullish trajectory.

At present, the Bitcoin price is testing this ascending trendline once again. The latest data shows BTC trading around $106,987, down nearly 6.94% over the previous session. The chart suggests that if the trendline support near $105,000 fails, a deeper retracement could unfold. This would mirror earlier breakdowns. The recurring pattern has made traders cautious, particularly as Bitcoin attempts to stabilize following its retreat from October highs near $125,000.

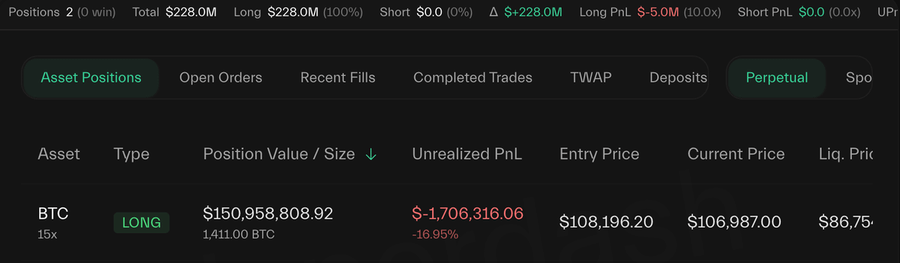

Insider Wallet Opens $150.9 Million BTC Long Position

While market sentiment turns cautious, new trading data also brings attention. According to a separate post shared by another market watcher, an “insider wallet” opened a $150.9 million long position on Bitcoin at an entry price of $108,196.20. This was leveraging fifteen-fold exposure.

The wallet’s unrealized loss stands at approximately $1.7 million (-16.95%), with the liquidation price recorded at $86,757. The scale of the position and timing, immediately following Bitcoin’s dip below $110,000, might fuel speculation that traders anticipate recovery from.

Wallet Data | Source: X

However, the aggressive leverage amplifies both potential profit and downside risk. At 15x leverage, even a 7% price drop could lead to forced liquidation. The position underscores how institutional and high-net-worth traders are positioning amid volatility. This means they are potentially betting on a rebound from oversold levels indicated on technical charts.

Technical Indicators Signal Potential Bottom Formation for Bitcoin Price

More charts present a different outlook, emphasizing a possible rebound setup. Daily Bitcoin price charts show Bitcoin’s Relative Strength Index (RSI) hovering around 36.47, signaling oversold conditions that historically precede short-term recoveries.

BTC/USDT Chart | Source: X

Analysts note that in prior instances, notably in April 2024 and August 2025, when RSI dipped below 40, Bitcoin rebounded strongly within weeks, often gaining 20%–30% before facing new resistance. The current RSI trajectory aligns with those reversal zones.

The price structure reinforces this observation. After touching the $105,200 horizontal support zone, the Bitcoin price bounced toward $107,517, as seen in the latest candle. The analyst behind this chart suggested that if BTC sustains above $105,000, the next recovery target could extend toward $135,000, representing a 26% potential upside from current levels.