TLDR

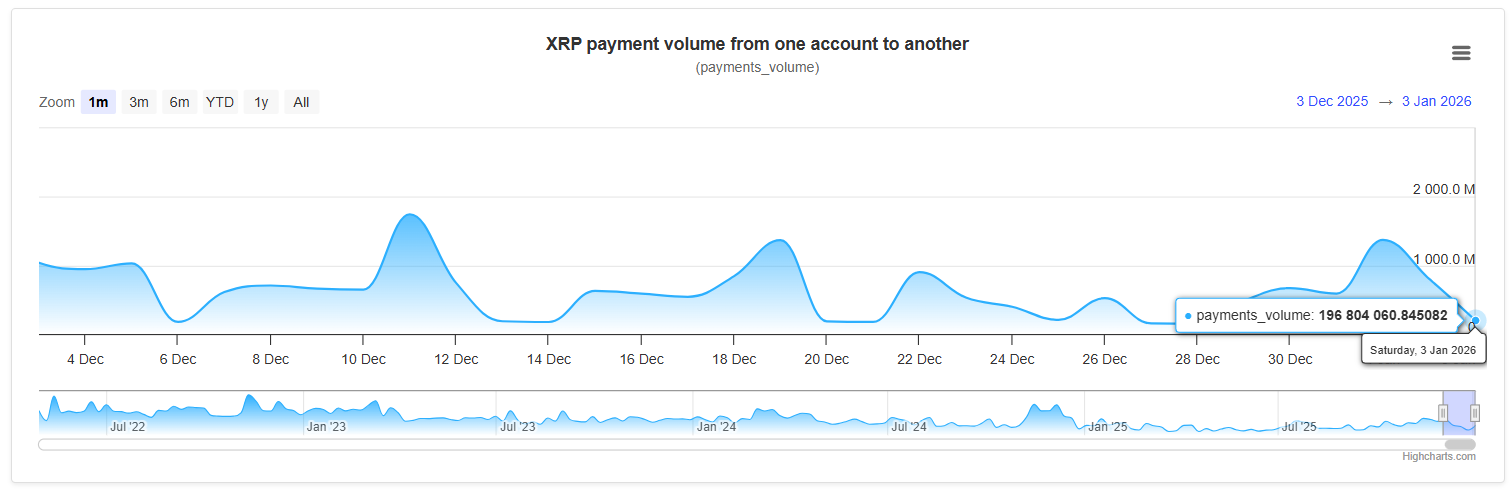

- XRP Ledger activity has dropped nearly 90% in both transaction count and volume.

- The decline occurred gradually and is not linked to recent price movements.

- Ledger payments remain low but have stabilized without further steep drops.

- Market price stayed steady despite reduced network usage and demand.

Recent on-chain data shows that activity on the XRP Ledger has decreased by approximately 90% from previous peak levels. This includes both the number and volume of transactions taking place on the network. The shift has occurred over time, rather than from a sudden crash.

The data reveals a prolonged slowdown in actual network usage. This includes fewer payment transactions and reduced movement of funds. Despite the drop in on-chain activity, the price of XRP has not seen a corresponding collapse.

No Immediate Market Panic

The market appears to have already absorbed the decline. XRP’s price continues to trade within a consistent range. This suggests that the network’s reduced usage has already been factored in by investors and traders.

According to analysis, the price action has followed a long-term downward trend. During this time, market volatility has decreased and ranges have tightened. These are typical signs of a reset period rather than a panic-driven selloff.

On-Chain Activity Has Stabilized

Though activity has decreased, it has not continued to fall in recent weeks. Metrics such as daily payments on the ledger have reached a lower, steady baseline. There is no indication of further rapid declines.

Experts point out that in late-cycle cryptocurrency markets, price and network usage often move independently. A drop in usage does not always cause a sharp drop in price. In this case, the ledger’s structural slowdown did not trigger any immediate collapse.

Outlook for XRP Remains Uncertain

The Relative Strength Index (RSI) has started to rise from oversold territory. However, no strong signals of a new upward trend have appeared. Traders and market participants are watching for signs of renewed activity or use cases.

If the XRP price rises again, it will likely come from broader market conditions or regulatory updates rather than internal ledger growth. Network usage would need to rebuild gradually to support long-term valuation increases.

The decline in activity acts as a filter, leaving behind only core users and infrastructure-level movements. What remains will shape XRP’s path forward—whether as a speculative asset or as a functional network ready to scale again.