TLDR

- Whales added 218,000 ETH worth $870M after offloading 1.36M ETH earlier in October.

- Whale accumulation marks renewed confidence as ETH steadies near $3,900.

- Market data shows whales reclaimed one-sixth of ETH sold earlier this month.

- Traders expect ETH to hit $5K as institutional demand and whale activity rise.

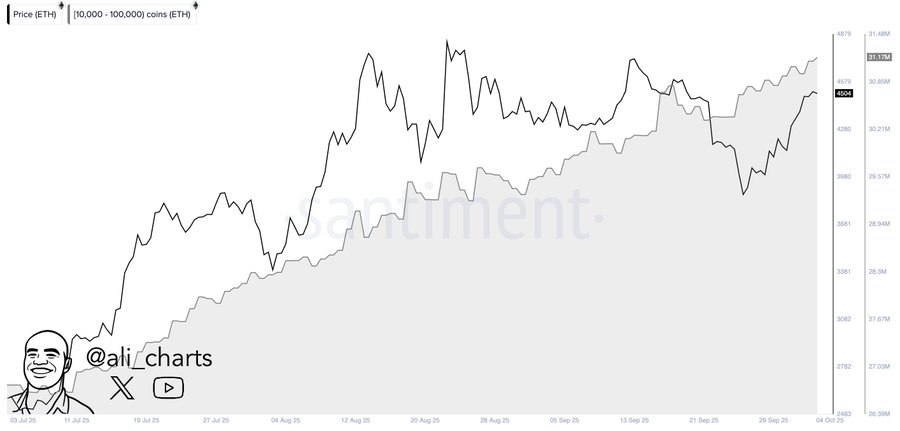

Ethereum whales have resumed large-scale accumulation after weeks of selling, purchasing over 218,000 ETH worth about $870 million. The renewed activity comes as the broader crypto market stabilizes following recent volatility tied to trade tensions. On-chain data suggests that large investors are regaining confidence in Ethereum’s long-term potential, even as the token remains below the $4,000 mark.

Whales Resume Accumulation After Selling Phase

On-chain data from blockchain analytics platforms shows that wallets holding between 100 and 10,000 ETH have been actively buying again. Between October 24 and 25, these addresses added more than 218,000 ETH to their balances. At current market prices, this accumulation is valued at roughly $870 million.

This trend follows an earlier sell-off between October 5 and 16, when the same group of holders offloaded around 1.36 million ETH. That period coincided with one of the most volatile stretches in the crypto market, during which over $20 billion in leveraged positions were liquidated.

The sell-off came shortly after U.S. President Donald Trump announced a 100% tariff on Chinese imports. The announcement led to a

temporary selloff across risk assets, including cryptocurrencies. However, recent whale purchases suggest growing optimism that the market is stabilizing and that Ethereum’s fundamentals remain strong.

Confidence Slowly Returning to Ethereum Markets

The renewed buying pattern among large holders has been viewed by analysts as a signal of returning confidence. Whales have now recovered nearly one-sixth of the ETH they sold earlier this month. This pattern has coincided with a modest recovery in Ethereum’s price, which gained about 2% this week to trade around $3,912 at press time.

Market observers believe whales are positioning for potential upside rather than reacting to short-term price movements. The increased stability in ETH’s price supports the view that these investors are taking long-term positions. As one analytics firm noted, “This renewed whale activity could indicate that large holders see value returning to Ethereum’s ecosystem.”

Broader Market Outlook and Trader Sentiment

The uptick in whale accumulation has also influenced market sentiment among retail traders and derivatives platforms. On Polymarket, several bettors are speculating that Ethereum could surpass $5,000 by the end of 2025, with a smaller group predicting a push toward $10,000.

Market participants cite Ethereum’s expanding role in the tokenization of real-world assets, the growing stablecoin market, and institutional settlement systems as possible drivers of long-term demand. These use cases continue to draw interest from investors seeking exposure to blockchain-based financial infrastructure.

Analysts add that the network’s upcoming scaling upgrades could also strengthen its position in the broader crypto economy, making it more attractive for large-scale investors.

Ethereum’s Growing Role in Digital Finance

Ethereum continues to dominate the decentralized finance (DeFi) and smart contract ecosystem, supporting most tokenized and blockchain-based applications. Institutional adoption has increased through the use of Ethereum for stablecoin transfers and digital asset settlements.

If whale accumulation continues, it could suggest that major investors expect Ethereum to maintain its central role in the next cycle of digital asset growth. For now, the quiet but steady accumulation of ETH by large holders signals renewed confidence in the blockchain’s long-term resilience and its role in global decentralized finance.