TLDR

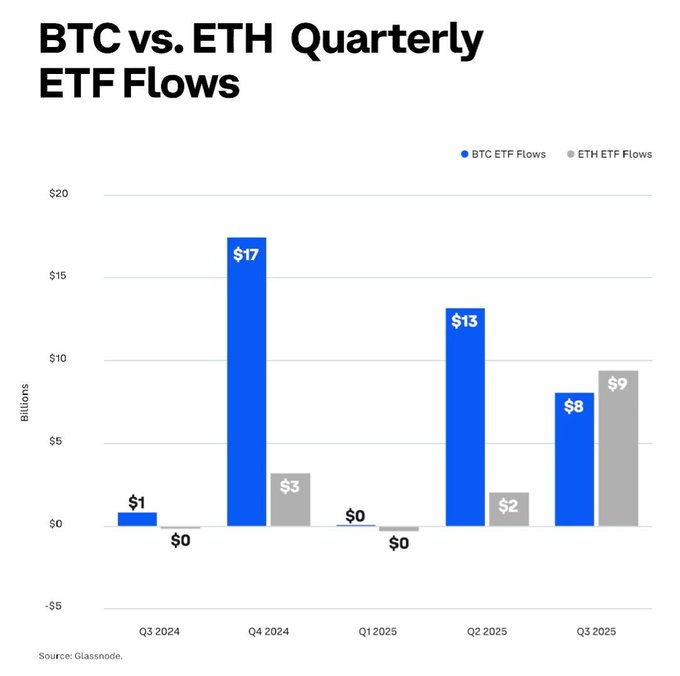

- Ethereum saw $9.6B in institutional inflows in Q3 2025, beating Bitcoin’s $8.7B.

- Staking rewards made Ethereum attractive to income-focused institutions.

- Ethereum ETFs gained approval after SEC eased concerns over staking.

- Layer-2 scaling and Fusaka upgrade boosted Ethereum’s institutional appeal.

Ethereum recorded a milestone in Q3 2025, pulling in more institutional capital than Bitcoin for the first time. With inflows totaling $9.6 billion compared to Bitcoin’s $8.7 billion, large financial firms are showing increased confidence in Ethereum’s evolving ecosystem. This shift comes amid growing interest in yield-generating assets and follows key regulatory updates that have opened the door for more institutions to engage with Ethereum-based products.

Ethereum Attracts More Institutional Capital Than Bitcoin

Ethereum saw institutional inflows of $9.6 billion in Q3 2025, overtaking Bitcoin’s $8.7 billion during the same period. This marks the first time Ethereum has led in quarterly inflows, pointing to a shift in investor strategy across the digital asset space.

The move comes as institutions look for more than just value preservation. Ethereum offers both income generation and smart contract utility, giving it a broader role in modern portfolio design. Bitcoin remains a popular choice as a long-term store of value, but Ethereum’s network enables a wider range of use cases, including decentralized applications and staking.

Staking and Yield Products Drive Ethereum Growth

Ethereum’s proof-of-stake model offers a consistent yield, making it more attractive to institutions seeking predictable returns. Staking rewards are now being incorporated into fund models, allowing managers to balance traditional and blockchain-based assets.

The staking process gives Ethereum a utility that Bitcoin lacks. Institutions are looking at the returns as part of their overall yield targets. “Yield opportunities have made Ethereum not just an asset, but a revenue tool for portfolio managers,” said one fund executive at a New York-based investment firm.

The growth of Ethereum’s layer-2 networks like Arbitrum and Optimism has also supported this trend. These scaling solutions have helped reduce costs and improve transaction speed, encouraging broader participation from financial institutions.

Regulatory Developments Boost Institutional Confidence

Regulatory clarity has also played a role in Ethereum’s rise during the third quarter. The U.S. Securities and Exchange Commission stated that staking on a protocol level does not qualify as a securities offering. This statement gave institutions more legal assurance when investing in staking-based products.

Following this update, several Ethereum-focused ETFs received approval, adding another entry point for large firms. These products provide regulated exposure to Ethereum, making it easier for compliance teams to authorize digital asset purchases.

Legal certainty has reduced hesitation around Ethereum, especially for traditional fund managers who must meet strict compliance standards. The ability to stake assets through regulated products has been key in expanding Ethereum’s reach in financial markets.

Ethereum’s Development Roadmap Supports Long-Term Demand

Ethereum’s network continues to evolve, and development remains active. The upcoming Fusaka hard fork is expected to improve performance and scalability. This development adds more confidence among institutional investors looking for long-term blockchain infrastructure plays.

Bitcoin remains a central asset in institutional portfolios, especially for those seeking inflation protection. However, Ethereum’s growth signals a new pattern, where institutions seek both stability and revenue generation from blockchain assets.

Ethereum’s broader utility and active development path are aligning with what financial firms expect from scalable, productive digital investments. As new upgrades roll out, more capital is likely to follow.