TLDR

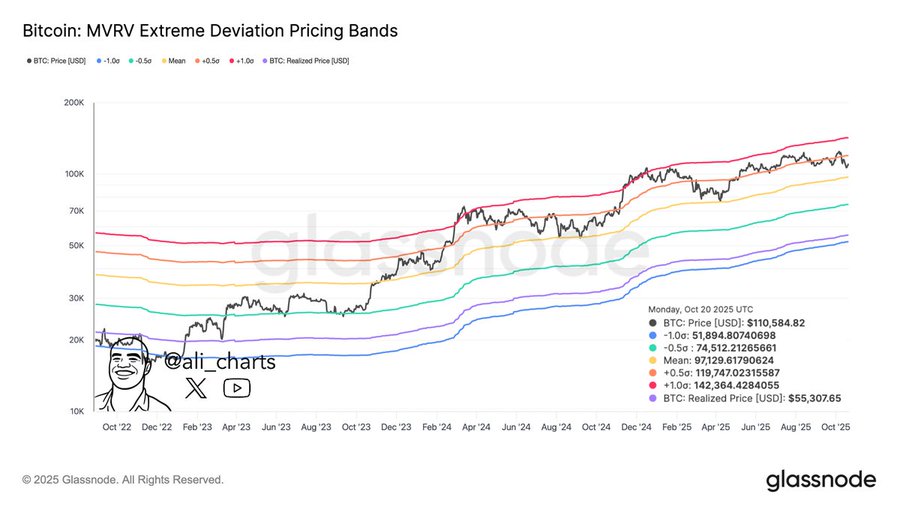

- Bitcoin trades at $110,584, well above its realised price of $55,307.

- The $106,000–$105,000 range remains the key short-term support zone.

- A break above $114,000 could push BTC toward $116,000–$118,000 targets.

- MVRV bands show a maturing cycle with reduced speculative activity.

Bitcoin is hovering around $107,800 after facing rejection at the $114,000 resistance zone, suggesting a cooling phase following its recent rally. Market data from Glassnode shows that the cryptocurrency remains well above its realized price, indicating profitable positions for most holders. However, analysts note that the MVRV deviation bands now signal a maturing cycle where traders are showing caution instead of exuberance.

Bitcoin Price Holds Above Key Support Levels

Bitcoin price remains stable within the $105,000–$106,000 support area after a brief correction from $114,000. This zone has repeatedly attracted demand during prior pullbacks, forming a reliable base for potential accumulation. Historical patterns show that this range often precedes renewed upward momentum, especially when long-term investors continue to hold their positions.

The broader picture shows that Bitcoin’s realized price stands near $55,307, with the market price nearly double that level. This gap, known as the MVRV multiple, implies that most investors are in profit. Yet, the proximity to the upper MVRV deviation bands suggests that speculative sentiment has cooled, reflecting a gradual transition from short-term rallies to steady accumulation.

MVRV Bands Show Market Cooling After Intense Gains

Moreover, the MVRV Extreme Deviation Pricing Bands indicate that Bitcoin has been consolidating below the +1.5σ deviation line, currently near $119,476. Historically, price movements above this level have marked overheated conditions, followed by temporary retracements or sideways trading phases. Presently, the price hovering below that threshold implies a healthy consolidation rather than a reversal.

BTC: MVRV Chart | Source: X

In addition, the +1σ deviation line at approximately $97,179 acts as a critical support benchmark. Maintaining levels above this point reinforces Bitcoin’s long-term bullish structure. A decisive drop below could, however, signal a transition toward the mean around $71,512, a level associated with cycle resets and renewed institutional accumulation.

Short-Term Structure Points to Potential Rebound

Following the sharp rejection near $113,900, the four-hour chart reveals a corrective setup forming a potential double bottom near $106,000. If buyers defend this level, the structure may complete a short-term rebound pattern. A sustained move above $114,000 would validate a reversal and open the path toward $116,000–$118,000.

BTC/USD 4H Chart | Source: X

Still, traders are cautious. A failure to maintain the $105,000–$106,000 support range could trigger deeper losses toward $104,000. While such a dip might appear bearish in the short term, it could also serve as a final liquidity sweep before broader market catalysts like ETF inflows or favourable macroeconomic data reignite bullish sentiment.

Bitcoin Cycle Appears to Be Maturing

Notably, recent patterns suggest that Bitcoin’s market cycle is evolving from retail-driven rallies to institutionally supported growth. Each test of the upper deviation bands has been met with controlled corrections rather than panic selling. This behavior implies that the current phase is one of distribution and reaccumulation rather than exhaustion.

For now, Bitcoin remains technically strong as long as it trades above $97,000. The market may continue to fluctuate between cooling phases and renewed breakouts, echoing previous cycles where consolidation set the stage for large upside moves. With investor profits still intact and volatility compressing, the next breakout could be brewing, though patience may be key in the days ahead.