TLDR

- US spot bitcoin ETFs saw $40.5 million in outflows on Monday.

- BlackRock’s IBIT led with $100.7 million in withdrawals from investors.

- Bitcoin fell 3% to $107,871 after briefly rebounding above $111,000.

- Spot Ethereum ETFs also saw $145.7 million in outflows the same day.

Spot bitcoin exchange-traded funds (ETFs) in the United States recorded another day of outflows on Monday, signaling a continued slowdown in institutional activity despite a brief rebound in bitcoin prices. The total net outflow reached $40.5 million, extending the losing streak to four consecutive trading days as investors adjusted positions amid volatile market movements.

Four Days of Continuous Outflows

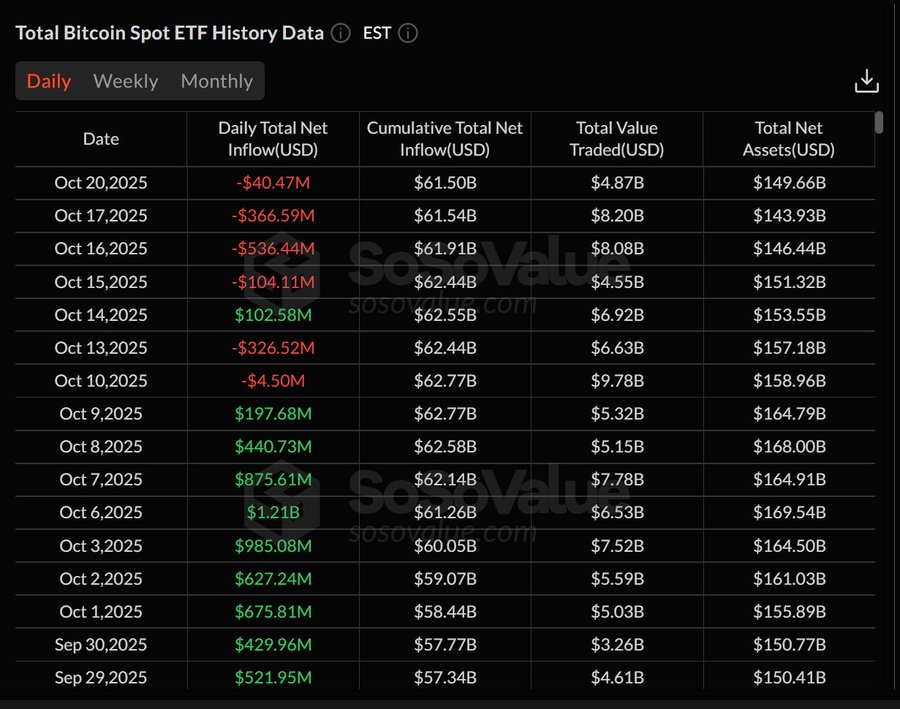

U.S. spot bitcoin ETFs have now seen four straight days of net outflows. According to data from SoSoValue, the total outflow on Monday amounted to $40.5 million. This followed outflows of $366.6 million on Friday and $536.4 million on Thursday, reflecting persistent withdrawals even as market sentiment showed signs of recovery.

BlackRock’s iShares Bitcoin Trust (IBIT) was the only ETF to record net outflows on Monday, losing $100.7 million. The negative flow from IBIT was partly offset by small inflows across funds managed by Fidelity, Grayscale, Bitwise, VanEck, and Invesco. These inflows, however, were not enough to reverse the overall decline in daily net activity.

The trend suggests a cautious stance among institutional investors as bitcoin’s recent price swings continue to influence short-term trading behavior.

Bitcoin Price Briefly Rebounds

Bitcoin briefly climbed above $111,000 on Monday before retreating again in the following 24 hours. As of 3:10 a.m. ET Tuesday, the world’s largest cryptocurrency was trading at $107,871, down about 3% from the previous day, according to The Block’s price data.

The rebound followed a three-day slump that had pulled bitcoin below $108,000, though market recovery efforts were short-lived. Analysts said the movement showed that retail and derivatives markets were absorbing some selling pressure even as institutional flows remained negative.

Vincent Liu, Chief Investment Officer at Kronos Research, told The Block, “Prices were climbing even amid ETF outflows when spot and derivatives demand offset institutional redemptions.” He added that these patterns reflected “market structure in motion with hedging flows, derivative rotations, and reporting lags” that obscure the relationship between ETF data and actual market demand.

Market Sentiment Remains Divided

The ongoing ETF outflows reflect differing views between retail and institutional traders. Retail investors and derivatives traders continued to show moderate buying interest, while institutional funds maintained a cautious approach.

ETF flows often move slower than direct spot and derivatives trading, which can cause a delay in reflecting broader market sentiment. While price rebounds suggest continued retail participation, institutional exits point to uncertainty over bitcoin’s near-term direction.

Market participants say this mixed trend could persist as investors balance between profit-taking and hedging strategies, particularly after bitcoin’s rapid rally earlier in the month.

Ethereum ETFs Also Record Outflows

Spot Ethereum ETFs mirrored the trend, recording $145.7 million in net outflows on Monday. This marked their third consecutive day of negative flows. Like bitcoin funds, Ethereum ETFs have faced selling pressure as traders reposition assets across digital markets.

The withdrawals highlight broader caution across crypto-linked investment products as volatility returns to the market. Both bitcoin and Ethereum ETFs had seen heavy inflows earlier in the year, but recent shifts in sentiment suggest investors are now seeking stability amid price fluctuations and shifting risk appetite.

Despite temporary rebounds in cryptocurrency prices, ETF data indicates continued capital movement away from spot funds, extending a four-day pattern of withdrawals across the U.S. market.