TLDR

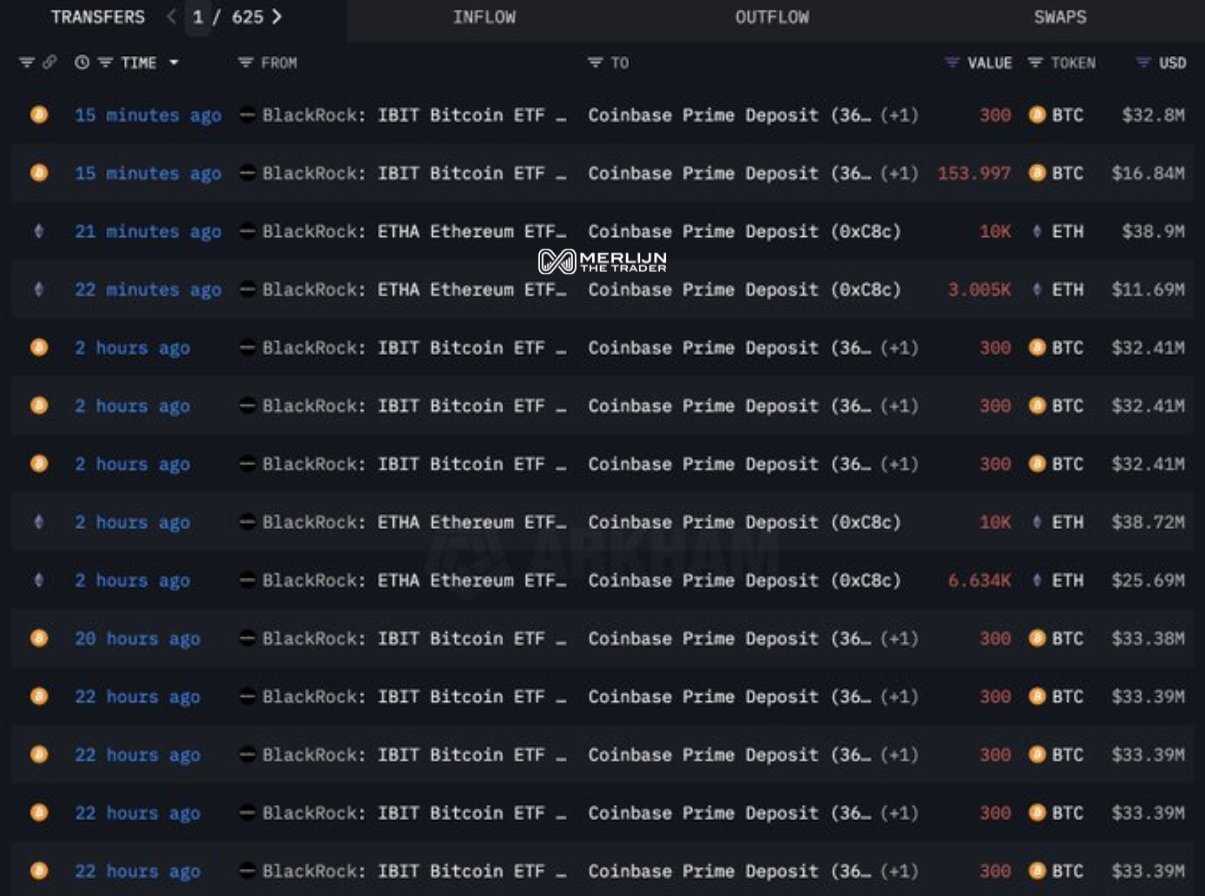

- BlackRock deposited $314M in Bitcoin and $115M in Ethereum into Coinbase Prime in a day.

- These crypto deposits align with BlackRock’s growing ETF portfolio management.

- Coinbase Prime offers institutional custody, trading, and brokerage for digital assets.

- BlackRock is using Coinbase Prime repeatedly for managing its crypto holdings.

BlackRock, the world’s largest asset manager, moved nearly $429 million in cryptocurrency assets into Coinbase Prime within 24 hours. The transfer included approximately $314 million in Bitcoin and $115 million in Ethereum. These transfers are part of BlackRock’s ongoing activity in cryptocurrency portfolio management and are closely tied to its expanding ETF offerings. The move signals the growing role of institutional platforms in managing digital assets.

Institutional Crypto Activity Expands With Major Transfer

BlackRock transferred around $429 million worth of cryptocurrency to Coinbase Prime in a 24-hour window. The assets included about $314 million in Bitcoin (BTC) and roughly $115 million in Ethereum (ETH). These transfers reflect ongoing portfolio management and coincide with BlackRock’s expanding focus on cryptocurrency ETFs.

Coinbase Prime is a platform used by large financial institutions for secure custody, trading, and brokerage of digital assets. BlackRock’s repeated transactions with the platform signal the firm’s continued use of established digital asset infrastructure for institutional-grade management.

Role of Coinbase Prime in Institutional Adoption

Coinbase Prime is specifically built for institutions seeking regulated and secure access to the crypto market. It offers custody, execution, and brokerage services for high-volume crypto trading. BlackRock’s use of the platform highlights the growing reliance on third-party custodians among traditional asset managers.

The repeated transfers by BlackRock show the company’s preference for working within compliant and secure crypto frameworks. According to Coinbase, the platform allows institutions to manage assets with transparency and strict regulatory standards, making it a suitable choice for firms like BlackRock.

ETF Strategy Driving Asset Allocation Moves

The deposits of Bitcoin and Ethereum appear linked to BlackRock’s cryptocurrency ETF strategy. As digital asset ETFs continue to gain traction, firms must hold actual underlying crypto assets to back their products. These Coinbase Prime transfers suggest BlackRock is maintaining or adjusting its holdings to match ETF flows.

BlackRock has been active in the ETF space with crypto-related products, including spot Bitcoin ETFs approved earlier this year. These products require secure custody of the assets backing them, and Coinbase Prime appears to be playing a key role in this.

Ongoing Crypto Adoption Among Institutional Players

This activity is part of a larger trend of traditional asset managers increasing their involvement in digital asset markets. BlackRock’s crypto-related actions represent broader adoption patterns by institutions looking to offer clients exposure to cryptocurrencies in a regulated environment.

The $429 million transferred to Coinbase Prime in under 24 hours demonstrates the scale and speed at which asset managers are moving in the crypto space. While the exact purpose of each transfer isn’t disclosed, the regularity of such activity suggests active asset allocation and portfolio balancing linked to product offerings.

BlackRock’s involvement reinforces the position of cryptocurrencies in mainstream financial systems. The company’s continuing use of Coinbase Prime reflects a systematic and regulated approach to crypto integration.