TLDR

- Ethereum has broken above $3,600, confirming a bullish breakout structure.

- Historical cycles show ETH rallies after two years of consolidation.

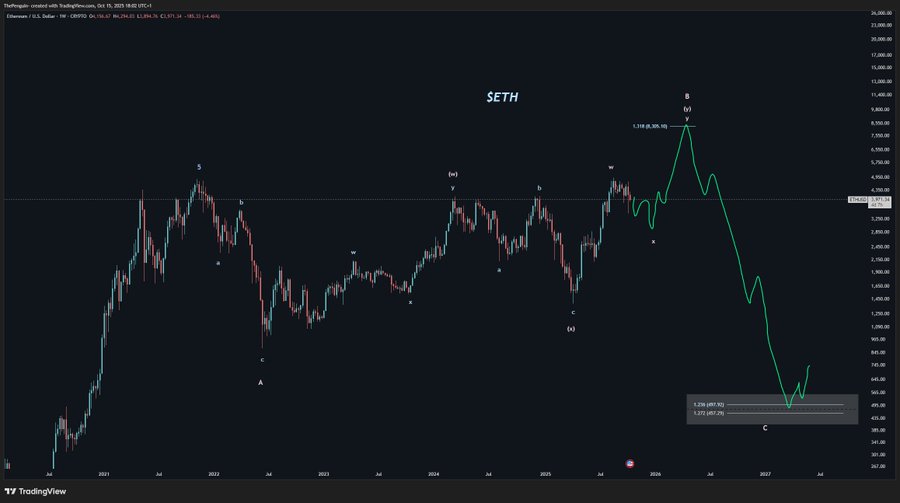

- Elliott Wave analysis signals a possible top near $4,200 before reversal.

- A full correction could drag ETH back to the $700–$900 range.

Ethereum’s long-term chart structure shows a familiar pattern of consolidation and breakout, a rhythm that has defined its major price cycles since 2017. The cryptocurrency’s performance above the $3,800 zone has renewed optimism among investors, though technical signals remain mixed. Analysts tracking the broader structure suggest that ETH could either be at the start of another parabolic phase or nearing the end of a prolonged corrective formation.

Ethereum Forms Familiar Macro Pattern

Ethereum’s historical trajectory reveals a recurring pattern of accumulation, breakout, and exponential growth. Between 2018 and 2020, ETH consolidated within a descending triangle, forming repeated lower highs with consistent support near $100. The eventual breakout in mid-2020 triggered a steep rally, propelling prices from below $300 to over $4,000 in less than twelve months.

ETH/USD 1W Chart | Source: X

A similar setup appears to have formed between 2022 and 2024. After peaking near $4,900 in 2021, Ethereum entered a long consolidation phase, again building pressure beneath descending resistance lines. Strong buying zones emerged around $1,300–$1,500, establishing a solid base for accumulation. The breakout above $3,600 this year mirrors the pattern that preceded its 2020 surge, suggesting structural strength may still be intact.

Historical Cycles Signal Possible Parabolic Expansion

Moreover, the chart’s white projection curve points toward a potential parabolic continuation that could take ETH above $10,000. Historically, Ethereum’s market rhythm has shown two-year periods of consolidation followed by sharp, exponential climbs. The recent breakout above $3,600–$3,800 resembles earlier moments that preceded major expansions, often supported by growing institutional inflows and renewed liquidity in global markets.

Still, traders remain cautious. While momentum indicators lean bullish, market psychology has shifted toward scepticism after months of uneven recovery. For this setup to mature, ETH must hold above its breakout range and sustain higher lows, validating it as a new cycle base. If history repeats, the next leg could mark Ethereum’s strongest rally since 2021.

Elliott Wave Theory Warns of a Correction Phase

However, the opposing perspective stems from Elliott Wave analysis, suggesting that Ethereum may still be trapped within a macro corrective A–B–C structure. According to this model, the 2021 top concluded the impulsive five-wave rally, and the asset has since been completing a complex correction. The ongoing rise toward $4,000–$4,200 could represent the terminal stage of wave (B), a pattern that often lures late buyers before reversing sharply.

ETH/USD 1W Chart | Source: X

Wave (C), if confirmed, might push prices down toward the $700–$900 range, aligning with past bear-cycle retracements. Such a decline would complete the corrective formation and set the stage for a new macro uptrend. Although this scenario seems distant amid current bullish sentiment, technical exhaustion near the $4,200 mark could trigger the beginning of that downward phase.

Traders Watch for Confirmation at Key Levels

Consequently, Ethereum’s next move depends heavily on how it reacts around $4,000. Sustaining support above $3,600 may validate the bullish breakout narrative and keep the parabolic trajectory alive. Conversely, a strong rejection or breakdown below this level could affirm the Elliott Wave projection and signal a deeper correction.

In essence, the market stands at a crossroads. Ethereum’s structure reflects both resilience and risk—strength built on cyclical repetition but shadowed by technical exhaustion. Whether it moves toward $10,000 or revisits $900 will depend on how long momentum can outweigh historical gravity.