- Cardano’s Diffusion basket hits 633,000 ADA in total value.

- ADA surges 12% to $0.72 during staking milestone announcement.

- Diffusion enables multi-pool delegation with ATMA token rewards.

- Cardano charts show massive uptrend after recent dip.

Cardano’s first staking basket, Diffusion, has amassed a massive amount in total value locked (TVL). The deposit represents ADA delegated across 50 single stake-pool operators (SPOs) simultaneously. It coincides with renewed buying pressure in ADA’s spot market over 12–13 October 2025, when prices climbed from roughly $0.65 to the mid-$0.72 range. An analyst who reviewed the on-chain and market data provided the commentary used in this report.

Cardano Staking Hits 633,000 ADA in TVL

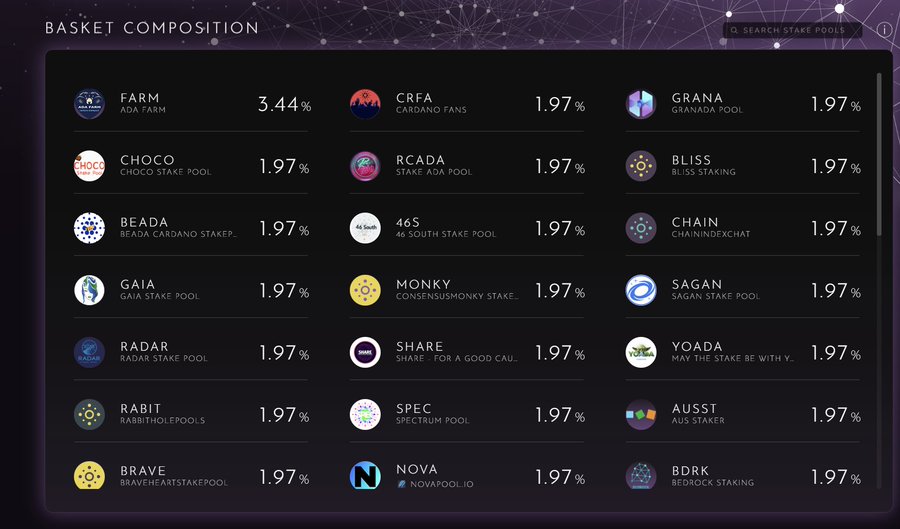

Diffusion, the network’s first Staking Basket product, reached 633,000 ADA in TVL after users deposited tokens that are automatically apportioned across 50 SPOs. The mechanism mints a Diffusion token representing each deposit. That token records the delegated ADA position and is redeemable for the underlying ADA plus staking rewards when claimed.

According to the product description supplied with the TVL announcement, Diffusion delegates simultaneously to 50 pools chosen by community vote earlier in 2025 and also issues ATMA native tokens as an additional reward layer on top of regular ADA staking returns.

Cardano Pools Data | Source: X

From a structural standpoint, Diffusion changes two mechanics of conventional delegated staking on Cardano. First, rewards are aggregated into the Diffusion token rather than distributed every epoch. Users do not automatically receive epoch-by-epoch staking payouts until they claim, a feature the Diffusion team says could affect the timing of taxable events in some jurisdictions.

Second, by spreading delegation across 50 pools, the product aims to reduce single-pool dependency. If a single pool goes offline, reward variance from that pool represents a smaller share of the overall basket.

Cardano Price Pumps 11% in a Day

CoinMarketCap data shows ADA priced at approximately $0.7212, a one-day price increase of 11.9%. TradingView hourly candles show a sharp market event and subsequent recovery earlier in the week. On 10–11 October 2025 a notable intraday sell-off was visible, followed by an uptrend starting approximately 12 October that formed an ascending channel across 12–13 October.

The marked channel shows the Cardano price moving from a lower bound near $0.60–$0.62 on 12 October up to the mid-$0.72s by 13 October. The Awesome Oscillator indicator on the hourly chart turned positive during this recovery phase, with an AO reading around 0.0389 on the chart timestamped 13 October 2025 12:00, signaling short-term momentum to the upside on the hourly time-frame.

one-week performance was noted at –16.42% while one-month performance was –21.61%. Three-month performance was mildly negative at –0.88%, six-month performance was +14.22%, 12-month performance +110.00%, year-to-date –21.32%, and five-year –39.27% for Cardano. Those multi-horizon metrics indicate a mixed backdrop: significant gains over 12 months contrasted with negative YTD and recent monthly returns.

A direct numeric comparison shows that prior intraday peaks on the hourly view reached prices near $0.88 on earlier candles visible in the TradingView screenshot, while the mid-October price settled around $0.72. The 12-month performance metric indicates substantial year-over-year appreciation of up to +110%, yet the one-week and one-month declines –16.42% and –21.61% show recent volatility.