TLDR

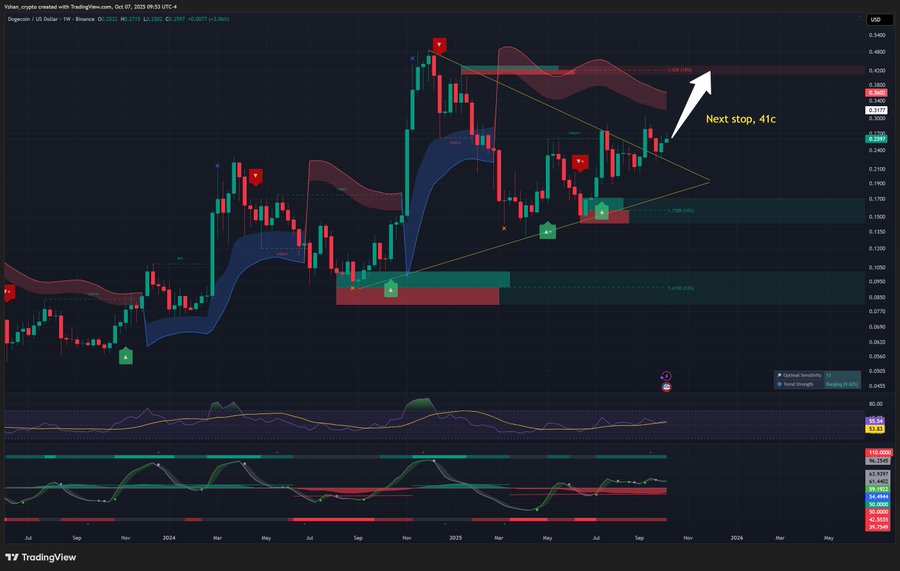

- Dogecoin forms a bullish symmetrical triangle after months of consolidation.

- A breakout above $0.30 could target the $0.41 resistance zone next.

- Long-term Elliott Wave pattern projects DOGE reaching $1.80–$2.00 by 2026.

- Key support remains strong near $0.05–$0.06, maintaining bullish structure.

Dogecoin (DOGE) appears to be approaching a critical turning point as technical indicators suggest mounting bullish pressure. After months of tight consolidation, DOGE has developed a symmetrical triangle pattern that reflects steady accumulation among investors. The setup shows growing optimism within the market, signaling that the next major move could define Dogecoin’s trajectory heading into 2025.

Dogecoin Price Consolidates Within a Symmetrical Triangle

The current DOGE/USD chart reveals a well-defined symmetrical triangle, a formation that often precedes strong directional moves. Price has repeatedly bounced between converging trendlines, suggesting consistent accumulation by traders anticipating an eventual breakout. The demand zone around $0.12 to $0.13 has acted as a reliable floor, reinforcing bullish sentiment.

DOGE/USD 1W Chart | Source: X

The upper resistance boundary near $0.30 remains a decisive level to watch. A daily or weekly close above this area could validate a breakout, potentially propelling the price toward $0.41, a target aligned with past supply zones. As compression tightens, traders are positioning for a decisive move that could define Dogecoin’s medium-term outlook.

Technical Indicators Align With Bullish Momentum

Furthermore, momentum readings provide further confirmation of building strength. The Relative Strength Index (RSI) has maintained an upward trajectory without reaching overbought territory, reflecting sustained buying pressure. The MACD histogram also shows steady growth, a sign that bullish momentum continues to build beneath the surface.

In addition, the Ichimoku Cloud’s thinning structure indicates that overhead resistance is weakening. A close above $0.28 could trigger a bullish crossover, often a precursor to sustained rallies. These technical signals, while not guaranteed, collectively suggest that Dogecoin may soon test higher resistance levels.

Elliott Wave Structure Suggests a Long-Term Cycle

At the same time, the broader weekly chart paints a more extended view of Dogecoin’s evolution. After peaking during the 2021 rally, DOGE completed a classic A–B–C correction that found its base around $0.05–$0.06. This accumulation zone has historically served as the launchpad for major bullish cycles. Analysts interpret the recent rebound as the beginning of a new Wave (III) extension within an Elliott Wave framework.

DOGE/USD 1W Chart | Source: X

If this pattern holds, Dogecoin could initially push past the $0.35 ceiling, followed by an advance toward the $1.00–$1.20 range. Over the longer term, projections extend as high as $1.80–$2.00 by 2026, representing the 1.618 Fibonacci extension of the previous cycle. Such a trajectory would signal a full macro recovery phase driven by renewed market participation and institutional inflows.

Support Levels Remain Crucial for Sustaining Momentum

Even so, despite the optimistic technical outlook, maintaining support remains critical. A decline below $0.18 would challenge the bullish thesis, potentially dragging price back to the $0.13 or even $0.10 region. This makes risk management essential as volatility increases near key breakout zones.

Still, as long as Dogecoin holds above its structural base and continues forming higher lows, the long-term trajectory favors continued upward progress. The combination of consolidating structure, improving indicators, and cyclical recovery supports the view that Dogecoin may be preparing for another significant rally phase—possibly its most decisive since 2021.