TLDR

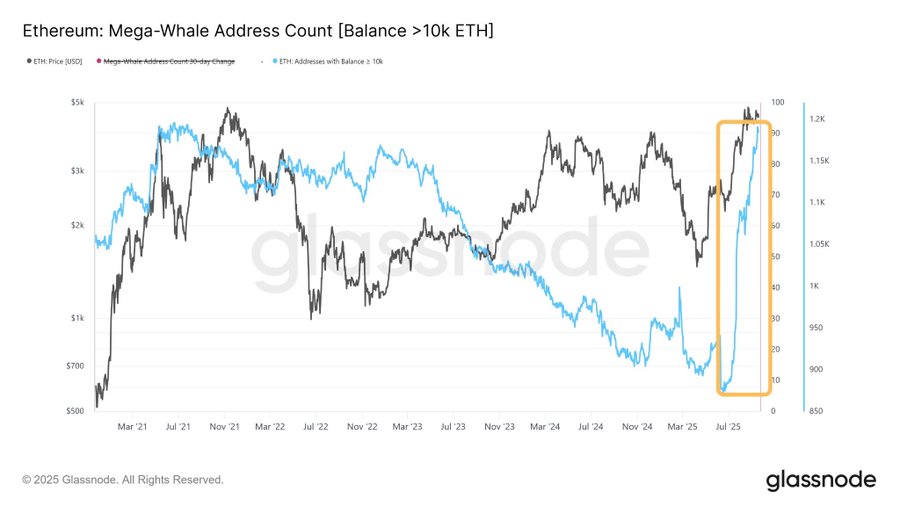

- Ethereum whale addresses holding over 10K ETH rebounded from 850 to above 1,150 in months.

- ETH price recently broke and held above the $3,600–$4,000 resistance zone.

- Current structure mirrors the 2019–2021 accumulation and breakout pattern.

- Sustained whale growth signals tightened supply and potential multi-year price expansion.

Ethereum is entering a new phase of market activity in 2025 as whales, accumulate significant holdings. On-chain data shows that addresses with over 10,000 ETH have surged after years of decline.

This structural change coincides with a price recovery beyond $4,000, resembling Ethereum’s 2021 bull cycle and signaling renewed institutional interest. Analysts see these developments as a key shift in supply and demand that could shape the next market trend.

Ethereum Price Structure Reflects 2021 Market Cycle

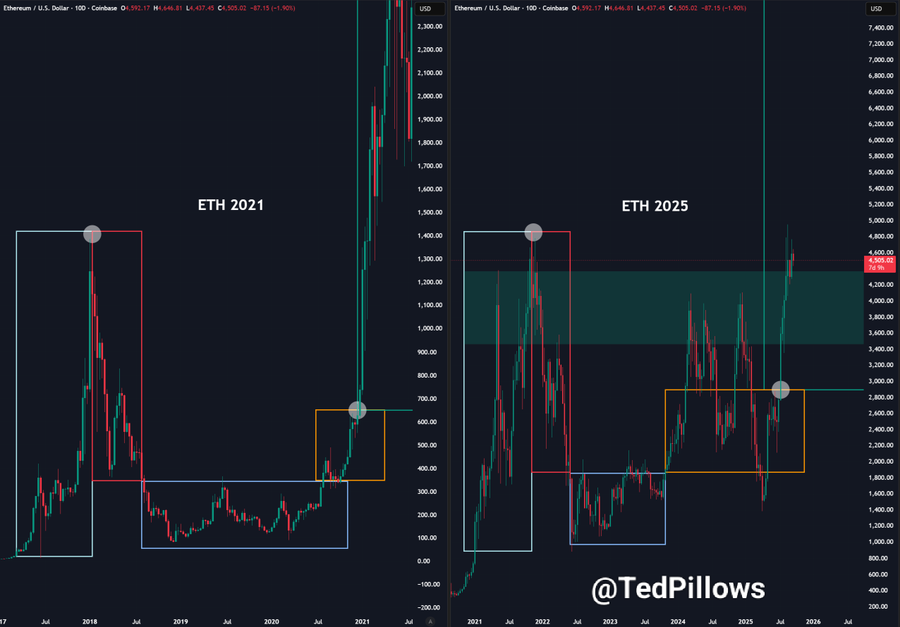

The Ethereum chart from 2021 provides a historical benchmark for current conditions. In that cycle, ETH consolidated for years between $80 and $400 before breaking above the 2018 high of $1,400. It briefly retested the $700–$900 range before a rapid climb to over $4,000. This pattern of accumulation, breakout, and strong expansion became a textbook example of a mature crypto bull phase.

ETH/USD 1D Chart | Source: X

The 2025 chart shows a comparable setup. Following a peak near $4,800 in late 2021, Ethereum spent years ranging between $1,000 and $2,500. Price has now moved above the $3,600–$4,000 resistance and tested the $2,800–$3,000 zone as support.

This resemblance to the earlier cycle suggests that Ethereum may be preparing for another broad rally if similar market conditions persist.

Mega-Whale Accumulation Strengthens the Uptrend

Furthermore, On-chain data from Glassnode reveals a sharp rise in addresses holding over 10,000 ETH. After declining steadily since mid-2021, the count rebounded from about 850 to more than 1,150 within a few months in 2025. This is the fastest growth in large holders seen in years and matches the timing of Ethereum’s break above $4,000.

MWAC 1D Chart | Source: X

Large-scale accumulation of this kind typically signals confidence from institutional investors and long-term market participants. These mega-whales often buy early in a cycle and hold for extended periods, effectively removing significant amounts of ETH from the liquid supply. A sustained increase above 1,100–1,200 such addresses could create a supply squeeze, lending additional support to Ethereum price growth in the months ahead.

Staking and Institutional Access Fuel Demand

In addition, The staking environment continues to attract long-term investors seeking yield while contributing to Ethereum’s network security. With Ethereum 2.0 staking and liquid staking services maturing, more ETH is locked away for rewards, reducing circulating supply. This aligns with whale accumulation, which further limits market liquidity.

Institutional participation is expanding through exchange-traded funds (ETFs) and regulated investment products. These developments make Ethereum more accessible to large financial institutions and funds that previously avoided direct crypto exposure. Together, staking and institutional inflows add consistent demand that supports a higher price base over time.

Market Outlook Requires Careful Monitoring

At the same time, the combination of strong price structure and large-holder activity paints a bullish picture, but conditions can shift. Global economic trends, regulatory changes, or sudden market corrections could slow the upward momentum. Ethereum must maintain its support above key levels like $3,600 to confirm a long-term breakout.

Even so, the evidence of renewed accumulation and structural alignment with the 2021 cycle offers a constructive backdrop. If the current trend holds, Ethereum could be positioned for significant gains beyond previous highs, supported by shrinking supply and growing institutional adoption.