TLDR

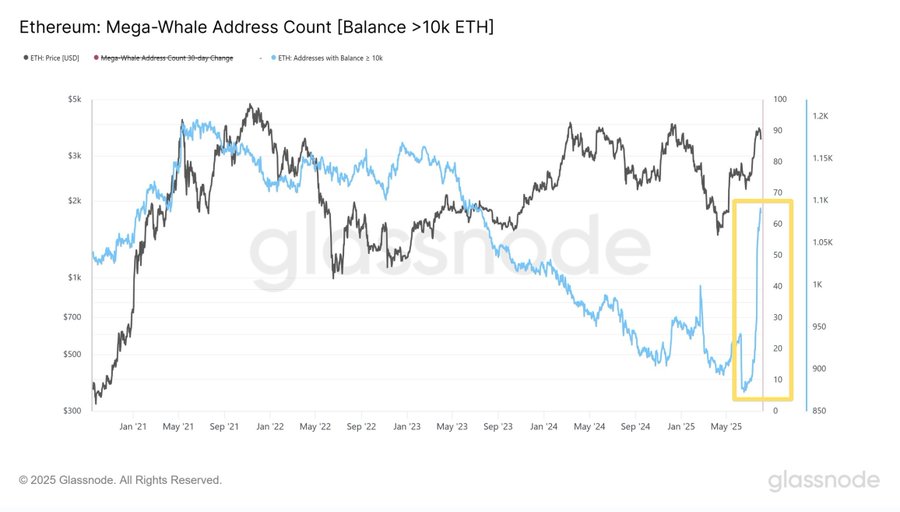

- Glassnode shows a sudden jump in Ethereum wallets holding over 10,000 ETH, reversing a long decline trend.

- Ethereum price climbs near $4,000 alongside the increase in mega-whale addresses, suggesting renewed large-scale accumulation.

- Shrinking exchange supply and ongoing staking raise the risk of a supply squeeze that can drive higher ETH prices.

- Layer-2 adoption and steady network upgrades support Ethereum’s long-term demand, adding strength to the current market outlook.

Ethereum has seen a sharp rise in mega-whale wallet activity, pointing to a potential bullish phase. Glassnode data shows a rapid increase in addresses holding over 10,000 ETH, a trend not seen since late 2023. This renewed accumulation could tighten supply and prepare the market for a possible rally as Ethereum trades near the $4,000 level.

Mega-Whale Accumulation Strengthens

Glassnode data reveals a notable upswing in Ethereum addresses holding more than 10,000 ETH. After a prolonged decline through 2024, the count of these wallets has rebounded sharply in recent months. Each of these addresses controls at least $40 million in ETH at current prices, signifying renewed confidence from large investors and institutional players.

ETH MWAC Chart | Source: X

This pattern often precedes major market moves. Similar expansions in mega-whale holdings coincided with strong rallies during early 2021 and late 2023. The latest increase suggests that these large holders may be positioning for Ethereum’s next significant price run, with the market watching for confirmation as ETH hovers near critical resistance levels.

Ethereum Price Action Aligns with Whale Buying

Furthermore, Ethereum price trend mirrors the uptick in whale accumulation. The asset has risen steadily alongside the growing count of large wallets, reinforcing the historical link between big address growth and bullish momentum. In past cycles, sustained buying by whales often set the stage for multi-month upward moves.

ETH/USD 1D Chart | Source: X

The current market structure shows Ethereum nearing a decisive breakout. If the pattern repeats, a move above the recent high could push the price into a new discovery zone. This alignment of price action with address growth creates a technical backdrop that supports ongoing accumulation and a potential strong rally.

Supply Pressure May Trigger a Squeeze

In addition, massive whale purchases reduce the amount of Ethereum available on exchanges. With each large address holding significant volume, liquid supply shrinks quickly when these entities accumulate. Combined with Ethereum’s staking mechanism, which locks more coins out of circulation, the chance of a supply squeeze rises.

A supply shortage can create upward price pressure if demand remains steady or increases. The combination of fewer coins on exchanges and rising investor interest could lead to faster price movements once a breakout occurs. This strengthens the case for a sustained bullish phase should current trends persist.

Broader Fundamentals Add Support

At the same time, Ethereum’s network upgrades and strong developer activity underpin long-term demand. Layer-2 scaling solutions continue to reduce transaction costs and increase capacity, while staking provides attractive yields for long-term holders. These factors create a robust foundation for price appreciation beyond speculative cycles.

Macroeconomic conditions also play a role. With global interest rates stabilizing and institutional adoption of digital assets growing, Ethereum stands to benefit from broader risk-on sentiment. A confirmed technical breakout supported by fundamental growth could signal the start of Ethereum’s next major market cycle..