TLDR

Table of Contents

Toggle- A Satoshi-era wallet transferred over $1.1B in Bitcoin to major exchanges.

The wallet initially sent 80,000 BTC to Galaxy Digital in two batches.

About 12,000 BTC worth $1.38B is still expected to be sold.

Analysts suggest these BTC sales may be absorbed without a market crash.

A Bitcoin whale wallet dormant since 2011 has moved more than $1.1 billion worth of Bitcoin to centralized exchanges. This wallet was part of a broader transfer of 80,000 BTC, originally valued at $9.7 billion. Galaxy Digital has reportedly received these coins in two large batches and has begun distributing them to major platforms.

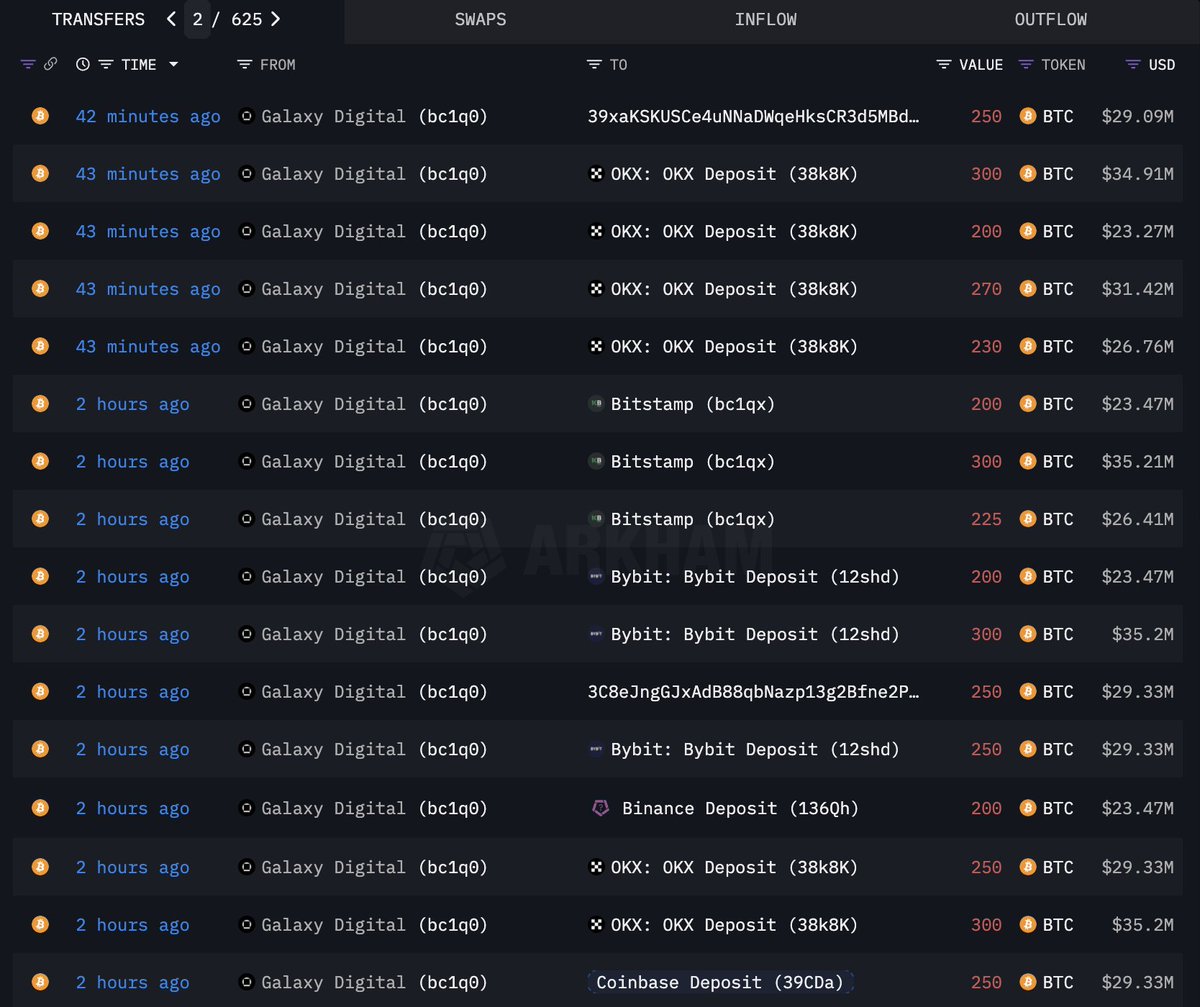

The initial transfer took place on July 15 with 40,000 BTC. Another 40,000 BTC followed on July 18. According to data from Lookonchain, over 10,000 BTC has since moved to platforms including Binance, Bybit, Bitstamp, Coinbase, and OKX.

Lookonchain posted, “The 10,000+ $BTC comes from the Bitcoin OG holding 80,009 $BTC ($9.68B),” confirming the origin of the funds.

Market Observers Monitor for Bitcoin Price Effects

Despite market concerns over such large transfers, analysts believe the Bitcoin market might absorb the sales. The transfers occurred during a weekend period, usually marked by lower liquidity, which raised fears of a short-term price drop.

Jacob King, CEO of WhaleWire, posted on X that Bitcoin is “propped up by fake money,” warning that such movements could lead to sharp corrections. However, data from Bitfinex suggests otherwise. Their analysts noted, “Dormant whale movements have not consistently preceded corrections,” and said that regulatory clarity is driving longer-term interest.

Analyst EmberCN mentioned that around 12,000 BTC remains to be sold, worth an estimated $1.38 billion. These coins are believed to be distributed through both over-the-counter and secondary market sales, which could reduce the pressure on exchange prices.

Institutional Buying and Trading Behavior Shift

New data suggests that these old Bitcoin holders may be selling to long-term institutional buyers instead of retail investors. Ki Young Ju, CEO of CryptoQuant, said,

“Last cycle, whales sold to retail. This time, old whales sell to new long-term whales.”

This reflects a shift in how Bitcoin is being accumulated. The current cycle appears to involve more large entities accumulating coins instead of quick retail turnover. This could result in stronger long-term holding patterns.

Meanwhile, an unidentified whale has taken a $23.7 million bullish position on Bitcoin, targeting a price of $200,000 by year-end. The position was placed via a call spread between $140,000 and $200,000, limiting both risk and reward.

Bitcoin Price Trend and Key Support Levels

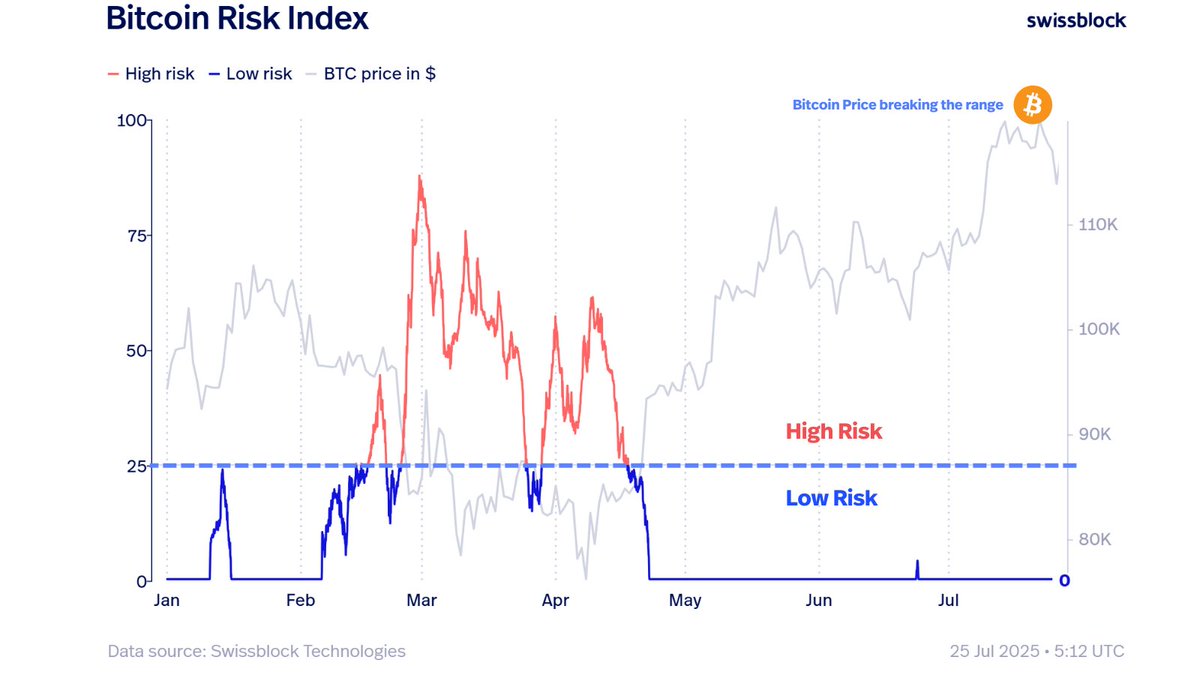

Bitcoin has traded around $116,000, with some pullbacks seen over the past few days. On July 25, BTC fell to $114,960, triggering $130 million in long liquidations across trading platforms. However, analysts say this was a normal correction in an ongoing uptrend.

Swissblock stated, “The trend remains bullish. Corrections at low risk levels = opportunity, not exit.” Their Bitcoin risk index remains at zero, suggesting no immediate risk of deep losses.

Technical analysts are watching the $115,000 level closely. A close below this could push Bitcoin toward $113,500. Should it break that level, prices might dip to $110,530, where buyers are expected to return.

Get 3 Free Stock Ebooks

Discover top-performing stocks in AI, Crypto, and Technology with expert analysis.

- Top 10 AI Stocks - Leading AI companies

- Top 10 Crypto Stocks - Blockchain leaders

- Top 10 Tech Stocks - Tech giants