TLDR

- Bitcoin price reaches $120,000 after whale withdraws $920M from Kraken.

Whale activity leads to a trading volume spike of $77.5 billion in one day.

Peter Schiff advises Ethereum holders to buy Bitcoin as its price rises.

Bitcoin ETF purchases and whale movements contribute to price surge.

Bitcoin price soared past $120,000 today following a large-scale whale activity. A massive withdrawal of $920 million worth of Bitcoin from Kraken exchange contributed to this surge. The whale’s actions were marked by three significant transfers within a span of 43 minutes, as revealed by Whale Alert.

These withdrawals, totaling over 7,700 BTC, resulted in a marked increase in Bitcoin’s price, briefly reaching $120,027. This surge coincided with a significant rise in daily trading volume, which spiked by 8.11%, reaching $77.5 billion.

Whale Withdrawals Drive BTC Price Surge

Table of Contents

ToggleThe Bitcoin price spike occurred after the whale moved large amounts of Bitcoin from Kraken to unknown wallets. The first transaction involved 4,166 BTC, worth over $496 million. This was followed by another transfer of 2,605 BTC valued at approximately $310 million, and a third transfer sent 947 BTC worth around $113 million. The total value of these transactions was a staggering $920 million.

These outflows were completed swiftly, suggesting that a single entity or coordinated group may be behind the move. The rapid succession of large transfers and the destination of the funds — wallets with no known affiliation — led to speculation that the whale intended to store their BTC in cold storage, reducing supply on the market.

Kraken has not issued any statement about the withdrawals, which occurred without any reported platform issues.

Increased Demand Pushes Bitcoin to $120,000

Bitcoin’s rise to over $120,000 reflects increased demand for the cryptocurrency, particularly amid ongoing accumulation trends by major investors.

Whale behavior often signals strong market confidence, especially when funds are moved off exchanges and into long-term storage. Such actions can influence the overall market, causing supply to tighten and pushing prices higher.

This withdrawal also aligns with the growing interest from institutional investors, who are increasingly adding Bitcoin to their portfolios. The launch of Bitcoin ETFs and continued institutional interest is contributing to upward pressure on BTC’s price. As the total trading volume increased by over $77 billion, it suggested that strong buying activity was driving the market upwards.

Peter Schiff’s Bitcoin Call Amid Ethereum Concerns

Amid Bitcoin’s price increase, well-known Bitcoin critic Peter Schiff shifted his stance. He advised Ethereum (ETH) holders to consider rotating their investments into Bitcoin.

Schiff, who has often spoken against Bitcoin, cited the strong upward trend in Bitcoin’s price as the reason behind his recommendation. He urged Ethereum investors to buy Bitcoin as its price trajectory appeared more favorable.

Schiff’s shift to a bullish outlook on Bitcoin further reflects the growing momentum in the market. His comments are particularly notable given his previous critiques of Bitcoin, indicating that even seasoned critics are starting to recognize Bitcoin’s market dominance.

Analysts Split on Bitcoin Long-Term Potential

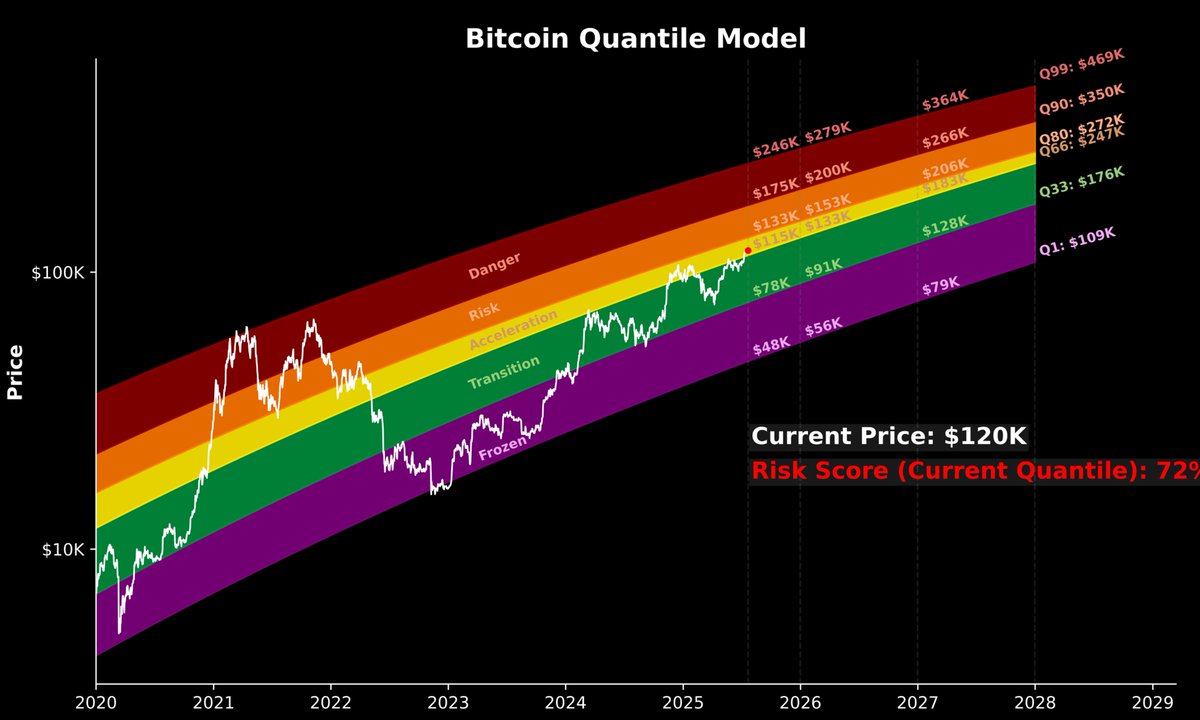

While Bitcoin’s current surge is being celebrated by many, some analysts remain cautious. Glassnode’s lead analyst James Check expressed doubts about BTC reaching $200,000 by the end of the year, citing the lack of significant buying volume needed to sustain such a price increase.

Check emphasized that while BTC might reach higher prices in the long term, it is unlikely to hit $200,000 in 2025.

Despite this caution, other analysts remain optimistic, with predictions that BTC could surpass $200,000 by 2025, driven by supply constraints and institutional demand. As more investors pile into the market, the conversation about BTC’s future continues to evolve.

Get 3 Free Stock Ebooks

Discover top-performing stocks in AI, Crypto, and Technology with expert analysis.

- Top 10 AI Stocks - Leading AI companies

- Top 10 Crypto Stocks - Blockchain leaders

- Top 10 Tech Stocks - Tech giants