TLDR

Two dormant Bitcoin wallets moved 20,000 BTC after 14 years, now worth over $2B.

Bitcoin’s 20,000 BTC transaction signals market speculation as value rises.

Long-term Bitcoin holders control 14.7M BTC, showing commitment despite volatility.

Bitcoin’s sudden wallet movement has sparked concern over potential market impact.

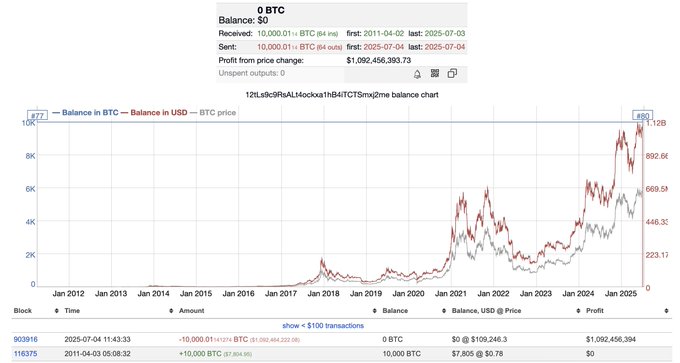

Two dormant Bitcoin wallet addresses moved 20,000 BTC after more than 14 years of inactivity. The wallets, which had not seen any transactions since their creation in 2011, became active on Thursday night. The two wallets each received 10,000 BTC from a single Bitcoin wallet address in 2011. This movement has drawn attention from cryptocurrency analysts and investors due to the size of the transaction and its timing in the current market environment.

The Bitcoin wallets involved had remained untouched for over 14 years, sparking curiosity about the reasons behind the sudden activity. On April 3, 2011, Bitcoin wallet address “1HqXB…gDwcK” transferred 23,377.83 BTC to three separate destinations. Of this amount, two wallets received 10,000 BTC each, while the third received 3,377.83 BTC. The initial transfer occurred when Bitcoin was valued at just $0.78 per coin. The 20,000 BTC, now worth $2.18 billion at current prices, had appreciated by 13,982,800% over the years.

The Awakening of Satoshi-Era Bitcoin Wallets

The two wallets that received the 10,000 BTC each had remained dormant until Thursday, when they were suddenly activated. According to on-chain data, the two addresses moved their Bitcoin holdings within a 30-minute window. The exact reasons for the movement remain unclear, and the identity of the owners of the wallets has not been disclosed.

Furthermore, it is unknown whether a single individual controls both wallets or if the funds belong to different entities.

The first recorded transaction for both wallets occurred when they received their respective 10,000 BTC in 2011. Since then, they had not moved any of their BTC, which has now gained substantial value. The move of these funds has sparked speculation within the crypto community about the intentions behind it. While some believe it could signal a sell-off, others suggest it could be a strategic decision to reposition or hold the Bitcoin for further gains.

Market Reactions and Speculation

The sudden movement of 20,000 BTC from dormant wallets raised concerns about potential market volatility. The value of the Bitcoin involved in the transaction has increased significantly since its original transfer in 2011. The BTC was initially worth approximately $15,600 when transferred in 2011, but it has now reached a value of over $2 billion.

As BTC price continues to trade around the $109,000 mark, analysts are closely monitoring any shifts in market sentiment that may result from this event.

Speculation has emerged about whether this Bitcoin whale intends to sell or if they are simply repositioning their assets. Some experts suggest that the movement could be part of a strategy to create a Bitcoin treasury, allowing the wallet holder to earn more BTC through various methods. The movement of such a large quantity of Bitcoin could potentially influence the market, though many long-term Bitcoin holders are maintaining their positions despite the fluctuations in price.

Long-Term Bitcoin Holders Maintain Strong Positions

Despite the concerns raised by the movement of 20,000 BTC, long-term BTC holders continue to maintain a dominant position in the market. According to data from Glassnode, long-term holders currently control a record 14.7 million BTC. These holders are less likely to sell, as most of their Bitcoin was acquired during previous price rallies, such as the $100,000 breakout. This suggests that many Bitcoin whales are committed to holding onto their assets, even as the cryptocurrency market fluctuates.

Bitcoin’s steady price movements and increasing institutional interest through products like exchange-traded funds (ETFs) suggest that long-term holders will continue to influence the market. The latest data shows that BTC ETFs have seen significant inflows, further supporting the strength of long-term holders in the market. As Bitcoin approaches its all-time high, it is expected that these holders will remain focused on preserving their assets, potentially contributing to further price appreciation.

The movement of dormant BTC wallets has brought renewed attention to the cryptocurrency’s volatility and long-term potential. The actions of these wallets, alongside the broader market trends, will continue to shape the future of Bitcoin trading and investment.