TLDR

Bitcoin price hovers near all-time highs, driven by long-term holders accumulating more, limiting selling pressure.

Cooling U.S. inflation may lead to a Fed rate cut, boosting Bitcoin’s appeal and potentially driving its price higher.

U.S.-China trade talks could spark Bitcoin rally, offering market stability and strengthening investor confidence.

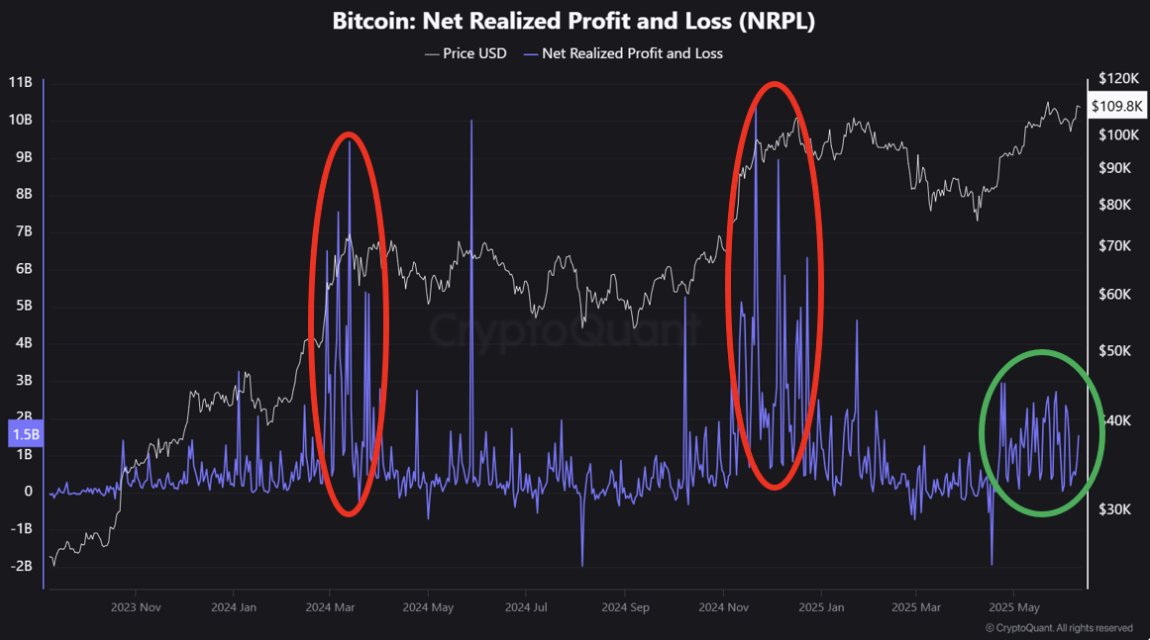

Bitcoin’s realized profit/loss ratio of 9.4 signals market euphoria, but demand could keep the rally going for months.

Bitcoin’s price has remained steady, hovering just below its all-time high of $111,800. With the cryptocurrency market showing strong momentum, questions arise about whether the price will break through and reach new heights. This speculation is amplified by the recent cooling of inflation in the U.S. and the ongoing U.S.-China trade talks, both of which could play crucial roles in shaping market behavior.

Bitcoin Price Resilience Amidst Market Uncertainty

Bitcoin’s price currently stands at $109,535, just a few percent below its all-time high. According to data from Glassnode, a blockchain analytics firm, long-term holders (LTHs) continue to dominate the wealth distribution even as the market approaches the later stages of a bull run. This is in contrast to previous cycles where profit-taking was more common among these holders at this stage.

The behavior of LTHs is creating a “unique dynamic” in this market cycle. These holders, defined as those who have kept their Bitcoin for over 155 days, are seeing significant profits but are not actively selling. Instead, they continue to accumulate more coins. The supply of Bitcoin held by LTHs is increasing, which suggests that selling pressure remains relatively low. This trend is being attributed to institutional investors and the growing influence of U.S. Bitcoin ETFs that favor long-term holdings.

Despite the rising supply held by LTHs, the realized profit/loss ratio is 9.4, indicating that most coins are being spent at a significant profit. Historically, such a ratio has coincided with market euphoria, often preceding a local or cycle top. However, there is also a possibility that the rally could continue for months if demand remains strong.

Cooling Inflation Could Boost Bitcoin Price

The recent U.S. Consumer Price Index (CPI) report showed inflation rose 2.4% year-over-year in May, lower than the expected 2.5%. Core CPI, which excludes volatile items like food and energy, held steady at 2.8%. The lower-than-expected inflation has given markets some relief, as it suggests that inflationary pressures are easing.

Market analysts believe that this could encourage the Federal Reserve to adopt a more dovish stance. With inflation contained, the Fed may be more inclined to reduce interest rates, which could further bolster the appeal of risk assets like Bitcoin.

“Falling inflation and the possibility of a rate cut could push Bitcoin into the final leg of its rally,” said Nic Puckrin, founder of Coin Bureau. This potential for a rate cut could lead to increased investment in Bitcoin, potentially driving its price toward new all-time highs.

Role of US-China Trade Talks in Bitcoin’s Future

In addition to inflation data, the U.S.-China trade talks are emerging as another key factor influencing Bitcoin’s trajectory. The outcome of these discussions could have a significant impact on market sentiment, affecting not only equities but also cryptocurrencies.

Nansen Principal Research Analyst, Aurelie Barthere, noted that U.S.-China relations are increasingly important for risk assets, including Bitcoin.

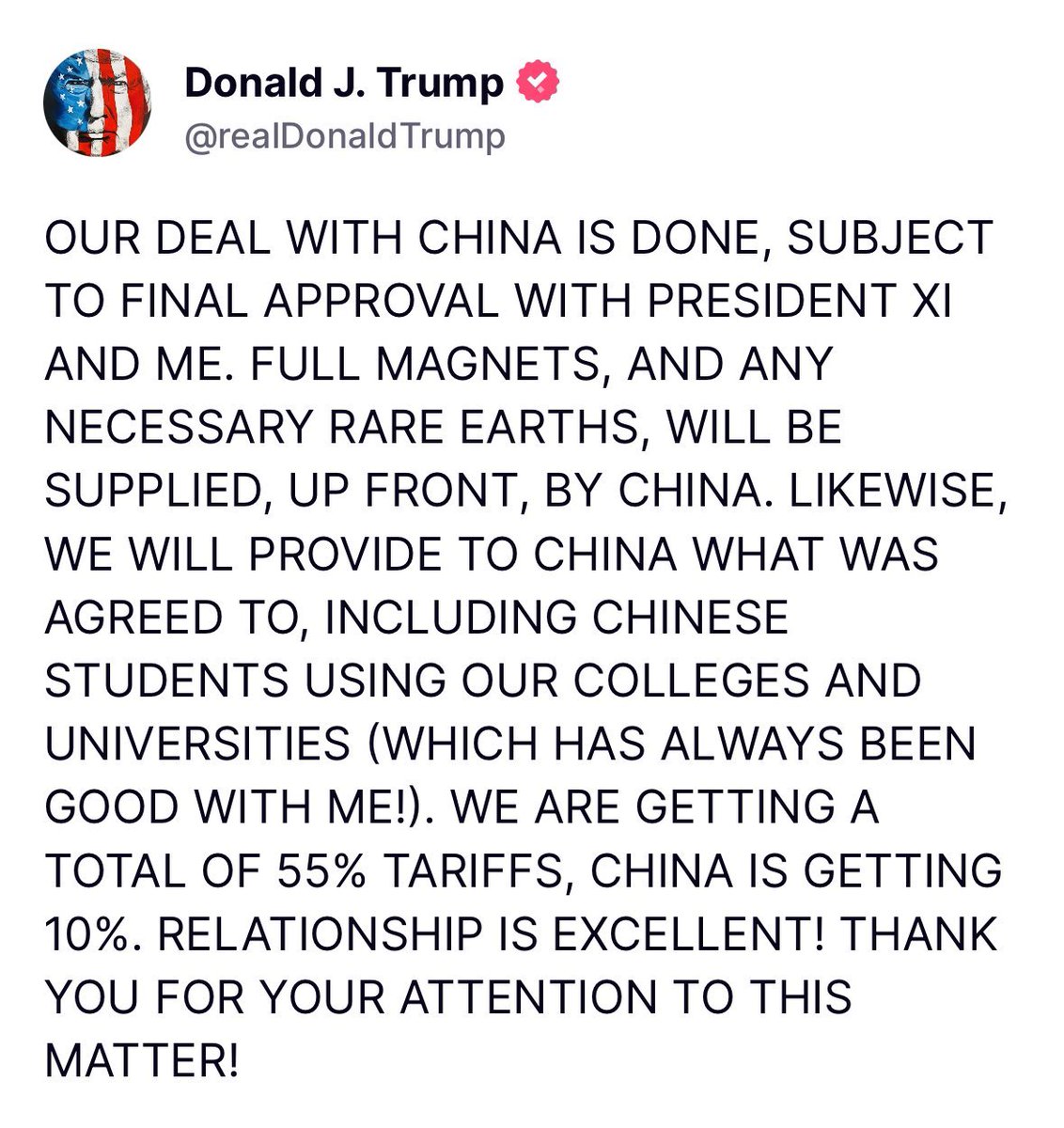

President Trump’s recent announcement of a finalized tariff deal with China could bring more certainty to the global market. The trade agreement, along with other diplomatic developments, may contribute to a more stable economic environment. This could foster a favorable climate for cryptocurrencies, as investors might view these assets as a hedge against geopolitical risks and inflationary concerns.

As the trade talks progress, further agreements could have a positive impact on Bitcoin’s price. Should these talks continue to yield favorable outcomes, the increased confidence in the market may fuel a rally in Bitcoin and other risk assets.